Nvidia has become synonymous with Wall Street's artificial intelligence boom, posting extraordinary growth numbers that seemed almost too good to be true. The chip giant's GPUs have powered everything from ChatGPT to autonomous vehicles, turning the company into a trillion-dollar darling. But recent forecasts hint that even Nvidia can't escape the laws of gravity forever. While the company remains the undisputed king of AI hardware, analysts are now penciling in more earthbound growth rates that, while still impressive, mark a clear shift from the stratospheric gains we've grown accustomed to.

Nvidia Price and Growth Expectations

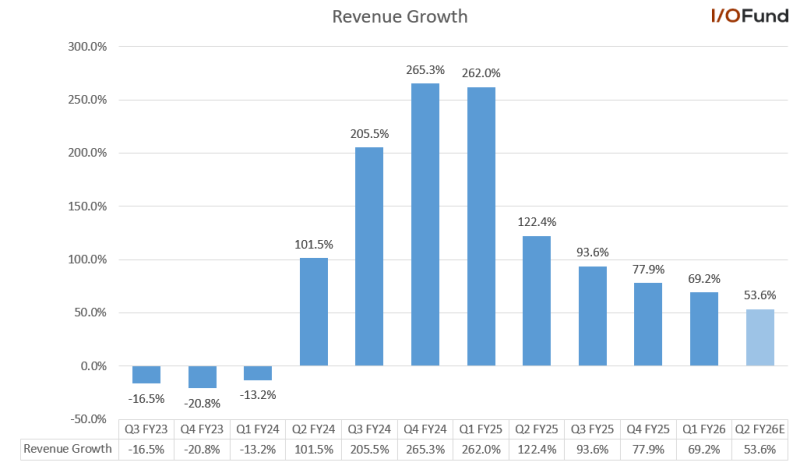

The numbers tell a story of normalization, though it's still a pretty spectacular kind of normal. According to analyst Beth Kindig's latest research, Nvidia's revenue growth is expected to moderate to 53.6% year-over-year in Q2 FY26. To put that in perspective, the company was posting growth rates of 265.3% in Q4 FY24 and 262% in Q1 FY25 – numbers that had investors doing double-takes and competitors scrambling to keep up.

Despite the deceleration, Nvidia is still projected to pull in $46.1 billion in revenue, a figure that would have seemed fantastical just a few years ago. Earnings per share are expected to jump 48.5% to $1.01, showing that while the top line may be cooling, the company's profit engine is still firing on all cylinders. This combination of slowing revenue growth but steady earnings momentum creates an interesting dynamic for investors trying to figure out where NVDA stock goes next.

From Hypergrowth to Sustained Expansion for NVDA

What we're witnessing is essentially Nvidia's transition from startup-like hypergrowth to something resembling mature company expansion – though calling 53.6% growth "mature" feels almost absurd. The trajectory has been unmistakable: those triple-digit growth rates that made headlines throughout 2024 and early 2025 are becoming a thing of the past.

But here's the thing – even this "slower" growth puts Nvidia leagues ahead of most semiconductor companies, which typically celebrate growth rates in the teens. The company's moat remains formidable, built on its CUDA software ecosystem, deep relationships with cloud giants like Microsoft and Google, and a GPU architecture that competitors are still trying to match. This isn't a company hitting a wall; it's one finding its cruising altitude.

Market Outlook: What's Next for Nvidia (NVDA) Price?

The upcoming Q2 earnings report will be crucial in determining whether investors can stomach this new reality of "merely excellent" growth. A revenue surprise above the $46.1 billion estimate could reignite some of that old magic and send the stock higher. Beat expectations on earnings, and you might see the bulls charge back in full force.

On the flip side, any disappointment could trigger concerns that the AI gold rush is cooling faster than expected. Some investors are already whispering about whether we've hit peak AI demand, though that seems premature given how early we are in the adoption cycle.

The bigger picture for Nvidia extends well beyond data centers. The company is making serious moves in automotive AI, where self-driving cars could provide the next major catalyst. Edge computing and networking represent additional growth avenues that could surprise investors. For now, though, all eyes are on whether Nvidia can keep that growth rate above the 50% threshold – a number that would have seemed impossible for most companies but has become the new benchmark for this AI juggernaut.

Usman Salis

Usman Salis

Usman Salis

Usman Salis