Nvidia's incredible run has reached a point where it's no longer just about the company—it's about the entire global financial system. When a single stock starts threatening to become bigger than entire countries' markets, that's when things get really interesting, and potentially scary.

Warns of Systemic Risk

Here's where things get wild. Trader @market_sleuth dropped a bombshell observation: if Nvidia tacks on just another $800 billion in market cap, it'll be worth more than Japan's entire Nikkei index. Let that sink in—one company potentially bigger than the world's second-largest stock market.

This isn't just impressive; it's potentially dangerous. @market_sleuth warns that a sharp NVDA correction could create a domino effect that makes the 1998 Long-Term Capital Management collapse look like a warm-up act. When one stock carries this much weight, the whole system becomes vulnerable.

Investors are caught between two camps: those calling NVDA a "super-cycle growth story" and others screaming "bubble waiting to burst." Both sides might be right, which makes this situation even more precarious.

The question isn't just how high NVDA can fly—it's whether the global financial system can handle the turbulence if this rocket ship comes crashing down. With this much concentration in a single name, we're entering uncharted territory where traditional risk models might not apply.

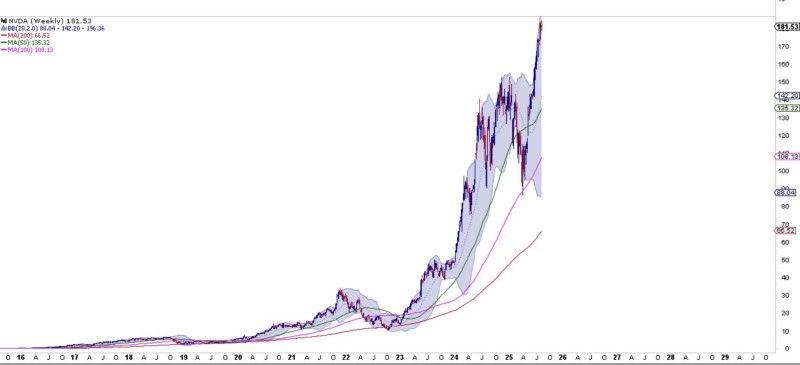

NVDA Price at a Historic Crossroads

Nvidia's meteoric rise has left everyone speechless. Trading at $181.53, NVDA is crushing its moving averages—sitting way above the MA50 at $135.32, MA100 at $108.13, and MA200 at $66.52. These aren't just good numbers; they're historically unprecedented for a company this size.

The weekly Bollinger Bands paint the picture perfectly: with a range of $88.04–$196.36, NVDA is dancing near the upper edge at $181.53. While this shows incredible momentum, it also screams overextension. The stock is basically living in rarified air right now.

Peter Smith

Peter Smith

Peter Smith

Peter Smith