What happens when a single company becomes worth more than entire countries? We're about to find out. NVIDIA's jaw-dropping ascent has created one of the most extraordinary financial situations in market history—a chipmaker from California is now breathing down the neck of Japan's entire stock market.

This isn't just another tech success story. It's a phenomenon that's rewriting the rules of market valuation and forcing investors to confront uncomfortable questions about bubbles, fundamentals, and what happens when hype meets reality.

NVIDIA Price Rally Shocks Global Markets

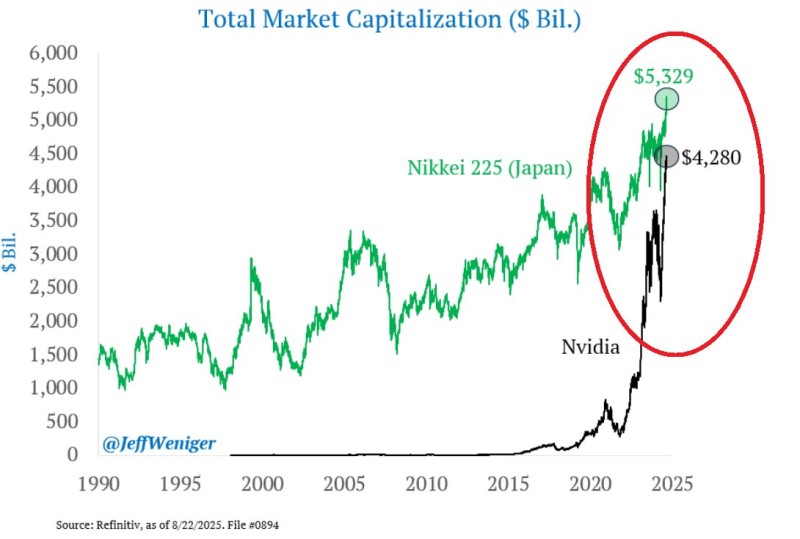

The meteoric rise of NVIDIA (NVDA) continues to astonish investors worldwide. The chip giant’s market capitalization has soared to $5.3 trillion, placing it within just $1 trillion of Japan’s entire Nikkei 225 market cap — the second-largest stock market in the world after the U.S.

Market analyst @GlobalMktObserv highlighted this extraordinary chart, noting how NVDA has now eclipsed the combined value of major economies such as the UK, China, Canada, France, and Germany. The comparison underscores not only NVIDIA’s dominance in AI and semiconductors but also the growing concerns about unsustainable market concentration.

NVDA Price and Market Cap Compared to Global Benchmarks

At the start of 2025, NVIDIA’s valuation stood near $4.28 trillion, already surpassing Europe’s largest corporations combined. Its latest climb to $5.3 trillion reflects the AI boom and the insatiable demand for GPU infrastructure, cloud computing, and machine learning solutions.

By contrast, Japan’s Nikkei 225 — which aggregates the performance of 225 of the country’s largest companies — took decades of growth to reach current levels. For a single corporation to challenge this scale highlights both investor confidence in NVIDIA and the speculative fervor surrounding AI.

Is NVIDIA’s Valuation Sustainable?

While NVDA remains the undisputed leader in AI hardware, many experts caution that such parabolic growth rarely continues indefinitely. History offers parallels: Japan’s own Nikkei boom of the late 1980s ended in a prolonged downturn, reminding markets that valuations eventually return to fundamentals.

Investors now face a crucial question — can NVIDIA’s revenues and profits catch up with its $5.3 trillion market cap, or will a sharp correction follow? Either way, NVDA’s rise has cemented its place as one of the most significant financial stories of the decade.

Usman Salis

Usman Salis

Usman Salis

Usman Salis