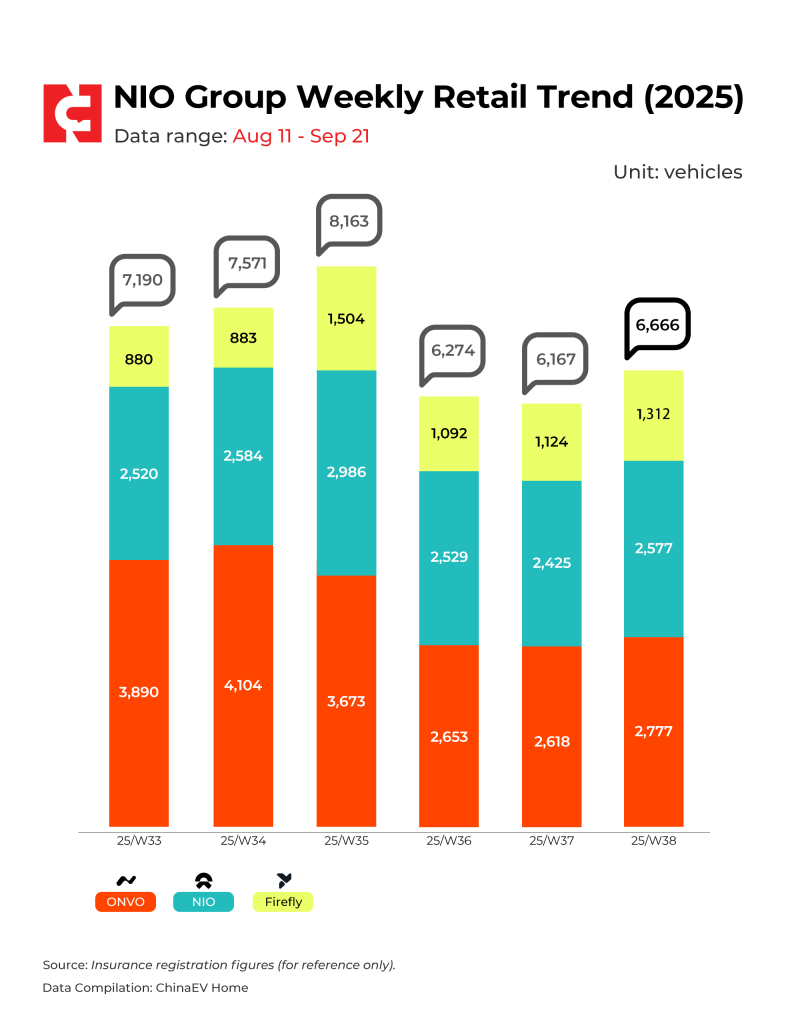

NIO Group's multi-brand approach is showing real results in China's competitive electric vehicle landscape. The company reported 6,666 insured units for the week ending September 21, demonstrating how its three-brand strategy—NIO premium, ONVO mass-market, and Firefly compact EVs—is working together to capture different market segments.

Strong Weekly Performance Across All Brands

Chinese EV manufacturer NIO (NYSE: NIO) delivered 6,666 insured vehicles during the week of September 21, according to data from ChinaEV Home. The breakdown shows the NIO brand contributed 2,577 units, ONVO added 2,777 vehicles, and Firefly delivered 1,312 units. This spread reflects healthy demand across NIO's entire brand portfolio and shows how the company is successfully targeting different customer groups.

The weekly chart reveals several key trends. The core NIO brand maintains steady performance in the 2,500-3,000 unit range, showing consistency in the premium segment. ONVO has emerged as a reliable growth driver, consistently delivering over 2,600 units and proving its value in the mass market. Meanwhile, Firefly crossed the 1,300-unit threshold last week, marking steady progress since its launch. Week 35 remains the standout with 8,163 total units, demonstrating NIO's capacity during peak demand periods. Although week 36 showed a temporary dip, the quick recovery in week 38 indicates underlying strength.

Investment Implications

These numbers come at a crucial moment for NIO investors. The company faces intense competition from BYD and Tesla, both pushing aggressive pricing strategies. However, NIO's diversified brand approach reduces dependence on any single market segment, spreading risk while expanding reach. The weekly insured vehicle data provides investors with near real-time insights into demand trends, offering more immediate feedback than quarterly reports.

Looking toward Q4, the 6,666-unit performance reinforces that ONVO and Firefly are becoming essential contributors to NIO's overall success. With the premium NIO brand holding steady and the newer brands gaining traction, the company appears well-positioned for a strong finish to 2025.

Peter Smith

Peter Smith

Peter Smith

Peter Smith