Electric vehicle manufacturer NIO just got a major vote of confidence from Wall Street, even as its stock price tells a different story. The contrast between analyst optimism and market reality highlights the complex dynamics facing Chinese EV stocks in today's volatile trading environment.

Nomura's Bold Upgrade

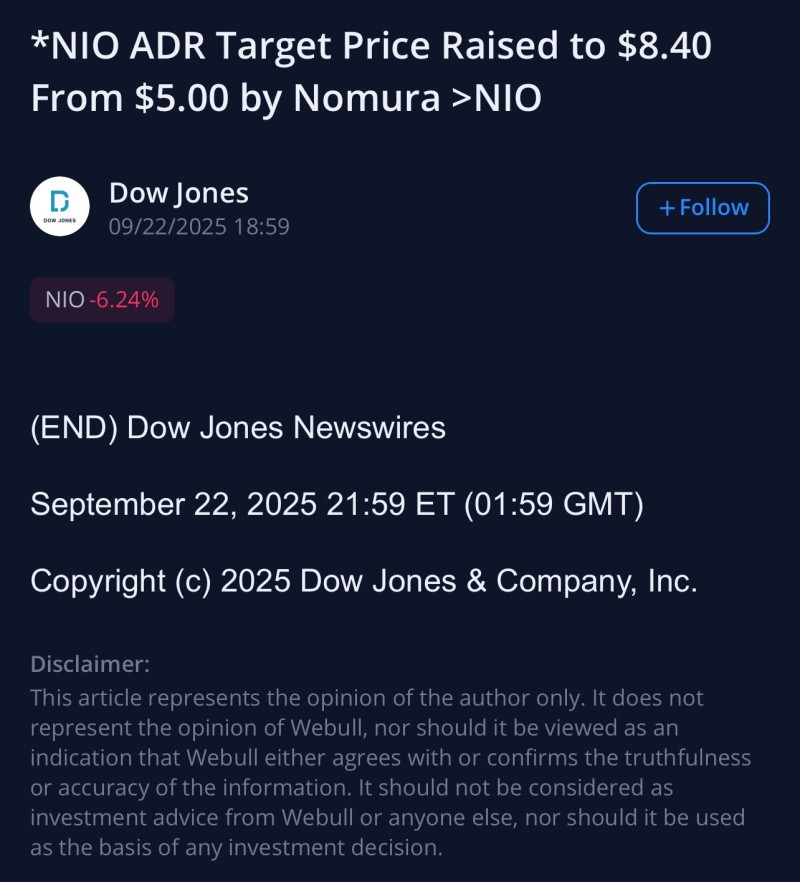

Nomura analysts delivered a significant boost to NIO's outlook, raising their price target from $5.00 to $8.40 while maintaining an "Outperform" rating. This 68% increase in the target price reflects growing confidence in the company's fundamentals and recovery prospects in China's competitive EV market.

According to Steve-DOGE-NIO, the timing of this upgrade is particularly notable given NIO's recent struggles. Shares dropped over 6% to $7.03 during the latest session, demonstrating the disconnect between analyst expectations and current market sentiment. According to trading sources, the revision signals renewed optimism about NIO's production capabilities and the broader demand recovery in China's electric vehicle sector.

Technical Picture and Market Dynamics

The stock's recent performance paints a picture of ongoing volatility and investor uncertainty. After opening sharply lower, shares fell nearly 5% before finding some stability just above the $7.00 level. This selling pressure comes despite the positive analyst coverage, suggesting broader market concerns may be weighing on investor sentiment.

Key technical levels are emerging as important markers for the stock's near-term direction. Immediate support appears solid around $6.80, a level that has previously acted as a critical floor during recent declines. On the upside, resistance is building in the $7.50 to $7.80 range, and breaking through this zone could potentially unlock upward momentum toward Nomura's revised target.

Strategic Implications

Nomura's upgrade comes at a crucial juncture for both NIO and the broader Chinese EV market. Early indicators suggest China's electric vehicle sales are beginning to stabilize after a challenging period, providing a more favorable backdrop for companies like NIO to execute their growth strategies.

The company continues expanding its product lineup, positioning itself as a credible alternative to established players like Tesla and domestic rival BYD. This product diversification strategy, combined with improvements in production efficiency, appears to be resonating with analysts who see potential for market share gains.

The psychological impact of a major global investment bank raising its price target shouldn't be underestimated. Such endorsements can help restore institutional confidence and potentially attract new investors who had been waiting on the sidelines.

Looking Ahead

While NIO faces continued near-term volatility, Nomura's $8.40 target represents a 19% upside from current levels and suggests faith in the company's longer-term prospects. The stock's ability to hold above current support levels while gradually working through overhead resistance will be crucial in determining whether this bullish thesis can translate into actual price appreciation.

Success will likely depend on NIO's ability to demonstrate consistent execution on both operational and financial metrics, particularly as competition intensifies in the Chinese EV market and global economic uncertainties persist.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah