Electric vehicle stocks are seeing some interesting movement lately, with traders starting to shuffle their positions between major players in the sector. Recently shared trade data shows how one trader took profits from betting against Tesla and immediately put that money into NIO shares. It's a small example of a bigger trend—people are hunting for value plays in the EV space.

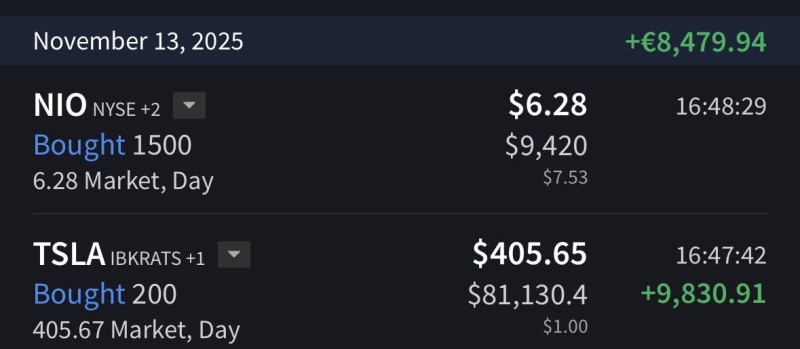

A recent tweet caught attention by showing screenshots of the actual trades: closing out half of a profitable Tesla short and buying 1,500 shares of NIO with the gains.

The Trade Breakdown

The screenshots tell a clear story. The trader picked up 1,500 NIO shares at $6.28 each, spending about $9,420 total. That price sits right in the range where NIO has been finding support lately, around the mid-$6 level where buyers seem willing to step in. On the Tesla side, the trader closed part of a short position by buying back 200 shares at $405.65, locking in a profit of $9,830.91. The green numbers on the screenshot confirm it was a winning move.

Tesla's been bouncing around quite a bit recently. There are ongoing questions about delivery numbers, tougher competition from Chinese EV makers, and mixed reactions to economic data. All of this creates the kind of volatility that short-term traders look for. The chart data matches the tweet perfectly—the profit figure is right there in green, and the NIO purchase details line up exactly as described.

Why Traders Are Looking at NIO Right Now

At roughly $6 per share, NIO presents what some traders see as an interesting risk-reward setup. It's speculative, sure, but if Chinese EV demand picks up again, the percentage gains could be significant. That's especially appealing after banking profits from a more expensive stock like Tesla, which trades above $400. Taking winnings from one volatile trade and putting them into a cheaper stock with potential upside is a classic rotation strategy.

Tesla remains one of the most actively traded large-cap stocks around, with sharp price swings that create opportunities for quick profits. When traders make money on those moves, they often look for places to redeploy that capital. Lower-priced EV names like NIO naturally attract attention in those moments. There's also growing chatter about the Chinese EV market potentially stabilizing, with expectations of government support helping domestic manufacturers. If that plays out, NIO could benefit as one of the leading Chinese brands.

What This Tells Us About the Market

This kind of capital rotation shows how traders are getting pickier about which EV stocks they want to hold. The premium names like Tesla still draw plenty of action, but value-oriented plays like NIO are pulling in money too. Tesla's volatility isn't going anywhere—it continues to create both risks and opportunities for active traders. Meanwhile, cheaper EV stocks might see more interest if the sector starts building positive momentum again. The screenshots demonstrate how one trader's Tesla profits directly funded NIO accumulation, and that pattern could repeat if more speculative money flows into the space.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir