NIO Group continues its impressive run in China's EV market, delivering over 10,100 vehicles last week—the third straight week above 10,000 units, demonstrating growing strength across its diversified brand lineup.

NIO Group's Third Consecutive Week Above 10K Deliveries

According to ChinaEV Home, NIO Group has consistently delivered above 10,000 units weekly since mid-October.

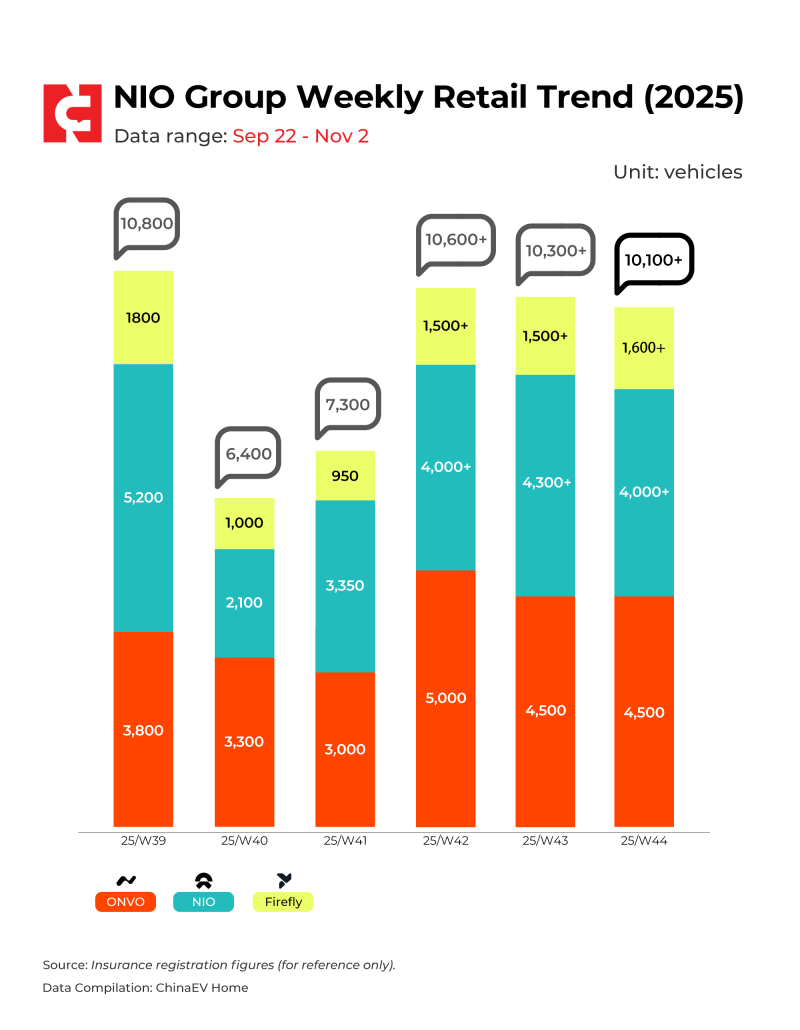

The latest week (W44) recorded 10,100+ retail registrations:

- ONVO: 4,500 units

- NIO: 4,000+ units

- Firefly: 1,600+ units

This matches the previous weeks—10,600+ in W42 and 10,300+ in W43—showing sustained stability in a competitive market.

Chart Analysis: Multi-Brand Growth and Market Balance

Registration data shows a clear upward trend from late September. Week 39 hit 10,800 units, led by ONVO (3,800) and NIO (5,200). A temporary dip to 7,300 in Week 41 reflected delivery scheduling adjustments. From Week 42 onward, sales stabilized at 10,000–10,600 units with steady demand across all brands.

ONVO remains the primary growth driver at 4,000–5,000 units weekly. NIO holds steady in the premium segment with 4,000+ units, while Firefly has gained traction with 1,500+ units weekly among urban buyers. This multi-brand approach successfully targets different segments, reducing dependence on any single category.

Broader Context: Strategy Behind the Surge

NIO's strength reflects its strategic shift toward brand diversification. ONVO, positioned in the mid-range family segment, competes directly with BYD and Tesla's Model Y. NIO's flagship brand attracts premium buyers through battery swap technology and AI-powered systems. Firefly extends reach into compact EVs, targeting smaller cities and ride-sharing markets.

These developments come as China's EV sector faces fierce competition and consolidation, making NIO's steady growth particularly noteworthy.

Technical Outlook: Stable Growth Amid Competition

Registration data shows consistent weekly totals above 10,000 since October, signaling market stability. While competitors face margin pressure from price cuts, NIO's blend of premium and mass-market offerings provides resilience. If this pace continues, NIO could close Q4 2025 with its strongest quarterly performance since 2023.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah