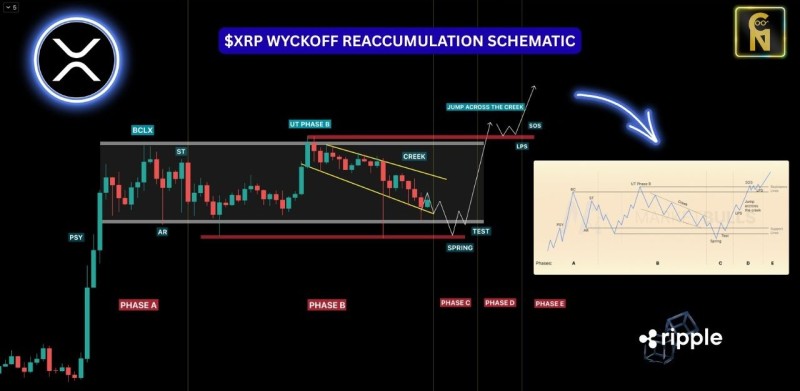

⬤ XRP has caught the attention of technical analysts as its recent price behavior matches up with a textbook Wyckoff reaccumulation setup. The focus right now is on the "Spring"—a crucial moment in Wyckoff methodology where price dips briefly below established support before bouncing back into the trading range. The pattern shows XRP working through several reaccumulation phases after an earlier price advance, and the Spring could be the make-or-break moment.

⬤ Looking at the structure, XRP has been moving through Phase A and Phase B, bouncing between clear resistance and support levels. Phase B is where things get interesting—the asset trades in a tightening range that forms a descending channel, sometimes called the "creek." This isn't a sign that the trend is dying out; it's more like the market finding its balance, with volatility getting squeezed as price stays locked within the bigger structure.

⬤ The Spring phase, which is getting highlighted in technical charts right now, shows up as a quick drop below support during Phase C, followed by a snap back into the range. In Wyckoff terms, this move is all about testing whether there's real buying interest and shaking out the last weak hands.

⬤ What comes next could include a potential test and what traders call a "jump across the creek"—moves that usually happen before stronger directional action kicks in, assuming the pattern holds. This technical setup matters because Wyckoff reaccumulation patterns are widely tracked as signals for trend continuation after a consolidation period. If the Spring plays out and price holds support, it could shift short-term momentum. But confirmation will depend on how XRP behaves in the phases ahead, making this current zone a must-watch area as the structure continues to develop.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah