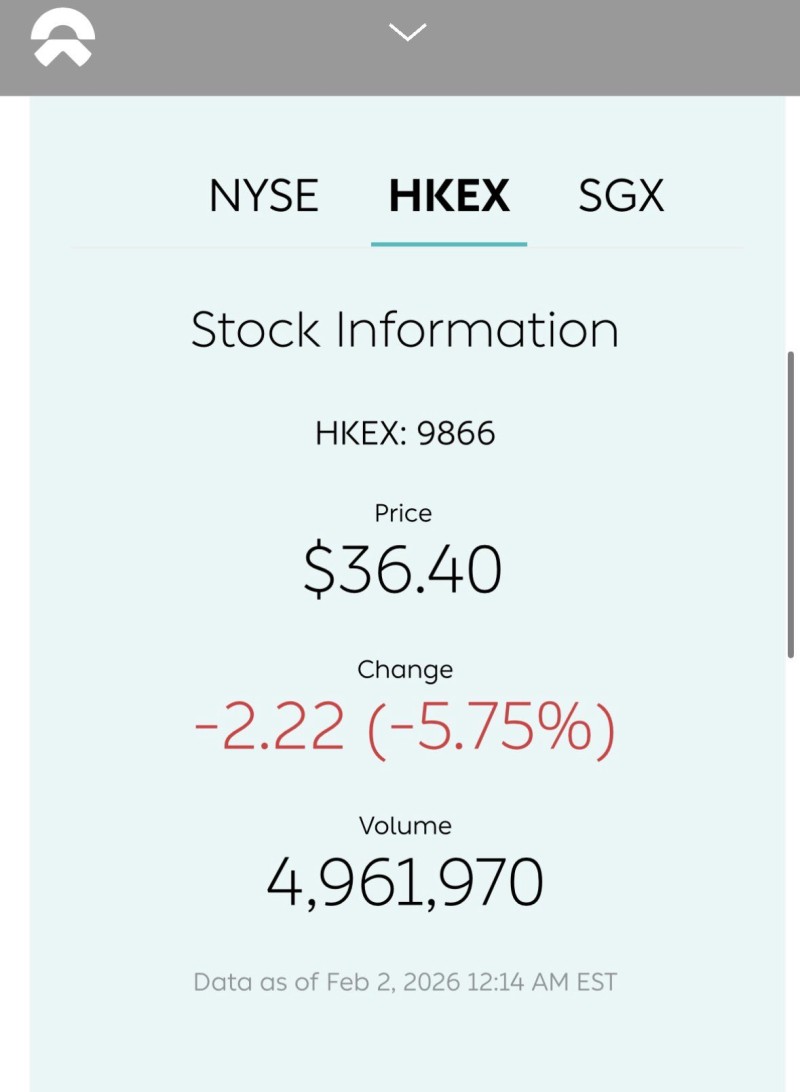

⬤ NIO shares took a hit in Hong Kong trading, with the stock sliding 5.75% to HK$36.40 as investors reacted to disappointing delivery numbers. The selloff came on the heels of fresh data showing a major sequential contraction in vehicle shipments. Trading volume spiked to nearly 5.0 million shares—well above recent averages—as the market digested the weaker-than-expected performance.

⬤ The real gut punch? NIO reported a 44% drop in deliveries compared to the previous month, catching traders off guard and triggering immediate downside pressure. That kind of sequential decline raised eyebrows, especially since delivery figures are the go-to metric for tracking operational health in the EV space. The news overshadowed everything else and put company fundamentals front and center.

⬤ From a technical perspective, this was one of NIO's sharpest single-day moves in recent weeks, erasing earlier gains and pushing the stock back toward cycle lows. The combination of heavy volume and steep losses suggests real conviction behind the selling—not just thin, reactionary trading. That makes this drop more significant than your typical intraday noise.

⬤ NIO's market reaction matters beyond just the stock itself. The company's often treated as a bellwether for China's EV sector, so when it stumbles, the whole space tends to feel it. The sharp response to delivery data shows how much weight the market's putting on execution and demand signals right now, especially with competition heating up across the board. If NIO can't stabilize deliveries soon, sentiment toward Chinese EV names could stay under pressure. All eyes will be on the next batch of operational updates to see if this was just a rough patch or the start of something bigger.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov