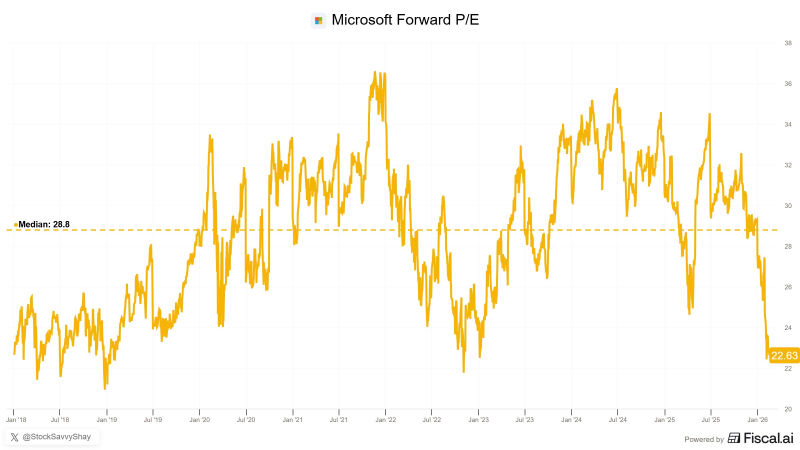

Microsoft is quietly sitting at one of its cheapest valuations in years, and the market doesn't seem sure what to make of it. With a forward P/E near 22.63 against a historical median closer to 28.8, MSFT looks like a very different stock than it did during the AI hype peak. But the underlying business story hasn't gotten smaller — if anything, it's gotten more concrete.

MSFT Forward P/E Near Multi-Year Lows While Azure Demand Outpaces Supply

A valuation chart circulating on X from Shay Boloor puts Microsoft's current forward P/E at roughly 22.63, which sits near the bottom of the range the stock has traded since 2018. Over that stretch, the multiple has swung from the low 20s to the mid-30s at various points. Right now it's closer to the floor.

What makes the setup interesting is the contrast: the multiple is compressed, but the operational picture being described is one of scarcity. Azure is reportedly sold out, and Copilot is now embedded across 450M+ enterprise users. The argument being made isn't that Microsoft needs to build the best AI model. It's that it already owns the distribution.

Copilot and Azure Capacity Signal a Revenue Conversion Story

The real debate isn't whether Microsoft is an AI company. It clearly is. The question is how fast it converts reach into revenue. CIO surveys show 53% of enterprise workloads already running on Azure, with 7.3% growth projected into 2026 — and Copilot continues rolling deeper into daily workflows across Office, Teams, and other tools that enterprise customers already pay for.

Microsoft doesn't need to win AI — it needs to monetize the distribution it already owns.

That installed base is the core of the bull case. Copilot doesn't need a new sales motion; it rides existing contracts and enterprise agreements. Pricing it, packaging it, and expanding it over time is a different kind of AI story than building foundation models. It's less about breakthrough, more about billing.

Cloud backlogs have hit record highs across the industry, which adds further context to why Azure capacity constraints aren't being read as a weakness. Demand exceeding supply can be a problem, but in this framing it's being treated as a queue — revenue that's coming, just not yet recognized.

Whether the forward P/E stays compressed or starts recovering will likely come down to how quickly that conversion shows up in actual earnings. Until it does, the valuation gap between what MSFT is trading at and what it has historically commanded will remain one of the more closely watched setups in large-cap tech.

Peter Smith

Peter Smith

Peter Smith

Peter Smith