Cloud spending tied to AI is accelerating at a historic pace. With OpenAI's projected FY25 revenue approaching $20 billion, enterprise demand for high-performance compute is pushing AWS, Microsoft Azure, and Oracle Cloud to record-breaking backlog levels. This raises a critical question: is this growth sustainable, or are we watching an AI bubble inflate?

The surge in AI compute demand is flowing directly into the revenue backlogs of Amazon, Microsoft, and Oracle, and the numbers are staggering.

AI Demand Becomes the Primary Growth Engine

A massive portion of future AI spending is already locked in: Amazon AWS shows $34B with 17% RPO, Microsoft Azure has $200B with 64% RPO, and Oracle Cloud leads with $300B at 67% RPO.

AWS maintains steady growth, reflecting long-term enterprise migrations and foundational AI workloads. The consistent pattern shows AWS remains the industry's baseline compute provider.

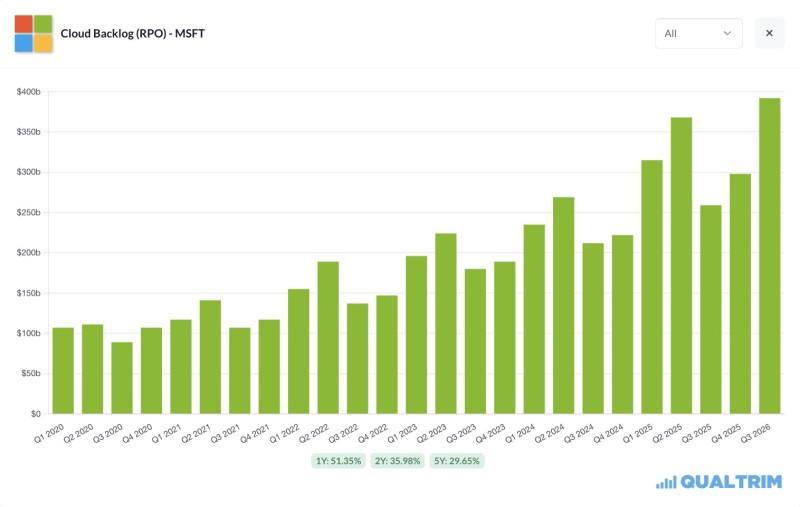

Azure's backlog surge directly reflects its OpenAI partnership. Every GPT training run, Copilot deployment, and inference workload flows through Azure infrastructure, explaining why 64% of Microsoft's AI-linked future revenue is already booked.

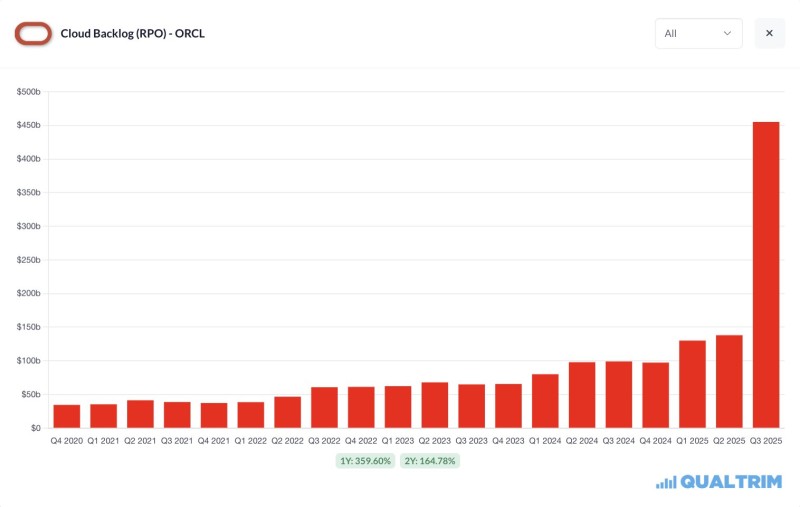

Oracle delivered the most dramatic performance. Aggressive GPU cluster expansion and strategic partnerships allowed Oracle to capture massive demand from companies struggling to obtain capacity from AWS and Azure, making it one of the fastest-growing AI infrastructure providers.

Key growth metrics across platforms:

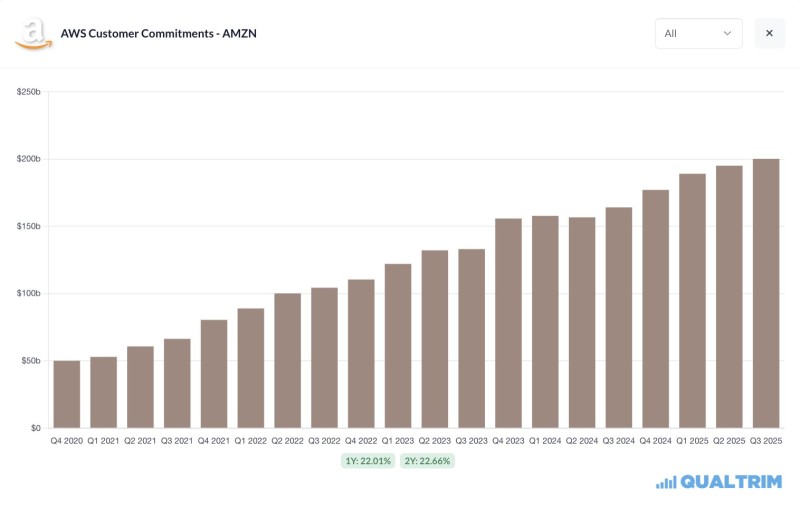

- AWS Customer Commitments climbed from $50B in Q4 2020 to $200B in Q3 2025, with 1-year growth at 22% and 2-year growth at 22.66%

- Microsoft Azure Backlog exploded from $100B in early 2020 to nearly $390B by Q3 2026, posting 51% 1-year growth and 36% 2-year growth

- Oracle Cloud Backlog delivered the most dramatic surge, jumping from $40B in 2020 to over $450B by Q3 2025, with an eye-popping 360% 1-year growth rate

The Bubble Question Emerges

With so much AI spending already booked, sustainability concerns are growing. Key risks include enterprise AI adoption lagging behind hype, compute scarcity inflating commitments as firms over-reserve GPU capacity, increasing model efficiency reducing cloud revenue, and market valuations assuming uninterrupted multi-year AI acceleration—a classic setup for volatility if reality disappoints.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir