Meta's impressive rally this year hit a wall when investors reacted strongly to the latest quarterly results. On October 30, 2025, Meta Platforms (META) shares fell 11.45%, sliding from near $750 down to around $665. This marks the company's biggest one-day loss since 2022, erasing weeks of gains. The selloff reflects growing worries about AI spending, rising costs, and concerns that profit margins could face sustained pressure going into 2026.

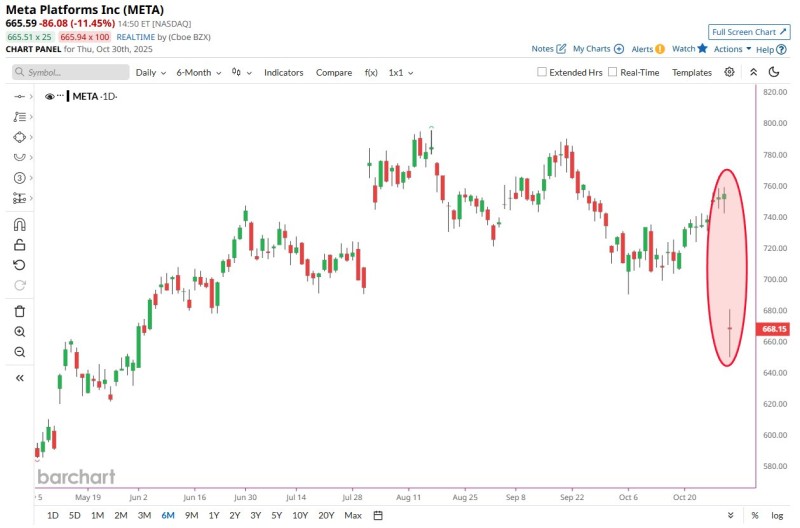

Chart Analysis: Massive Selloff After Earnings

The daily chart from Barchart shows a sharp bearish pattern, signaling heavy institutional selling. The stock gapped down at the open, and strong downside momentum carried through to the close. META plunged from around $750 to $665 in a single session.

The next major support sits near $650, where the stock consolidated back in September. Immediate resistance now stands near $720, the level where the selloff began. The vertical drop within one trading day indicates panic-driven selling, typically linked to disappointing earnings or weaker guidance. The chart clearly captures the post-earnings volatility spike, showing how quickly sentiment flipped from bullish to cautious.

What Triggered the Fall?

Meta's third-quarter report showed strong revenue but raised fresh profitability concerns. Revenue came in slightly above Wall Street forecasts, helped by steady ad growth and higher engagement across Facebook and Instagram. However, earnings fell short as Meta ramped up spending on AI infrastructure and metaverse development. The company also signaled that capital expenditures would stay elevated into 2026, especially for AI servers and data centers, which worried investors about near-term cash flow. This came at a time when the market was hoping for tighter cost control and better margins, leading to a rapid repricing of growth expectations.

Broader Context: Tech Volatility Returns

The Meta selloff mirrors a wider correction across mega-cap tech stocks following earnings season. Rising bond yields, persistent inflation, and cautious corporate outlooks have rekindled concerns about tech valuations. Other major tech names have faced similar turbulence. Alphabet slipped after cloud revenues missed expectations. Amazon and NVIDIA dealt with profit-margin pressure from their own AI investments. Meta's decline fits into this broader story where investors are demanding clearer paths to profitability in an environment of high borrowing costs and expensive AI expansion.

Can Meta Recover?

Technically, META's ability to hold above $650 will be crucial in determining whether this correction deepens. Staying above that level could trigger a short-term bounce toward $700-720. But if support fails, the stock might pull back further to $620. Fundamentally, the long-term outlook remains positive. Analysts view Meta as a leader in AI-driven advertising and mixed-reality technology, though investors may stay cautious until spending trends level off and free cash flow strengthens.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov