As Meta Platforms prepares to report earnings after the bell, the options market is flashing caution signals. Traders appear to be rotating out of bullish positions and loading up on downside protection, reflecting uncertainty about what the tech giant will deliver. With META stock hovering near $748, the shift in sentiment is clear—and it's raising questions about whether this is simple hedging or something more bearish.

Options Activity: Calls Sold, Puts Bought

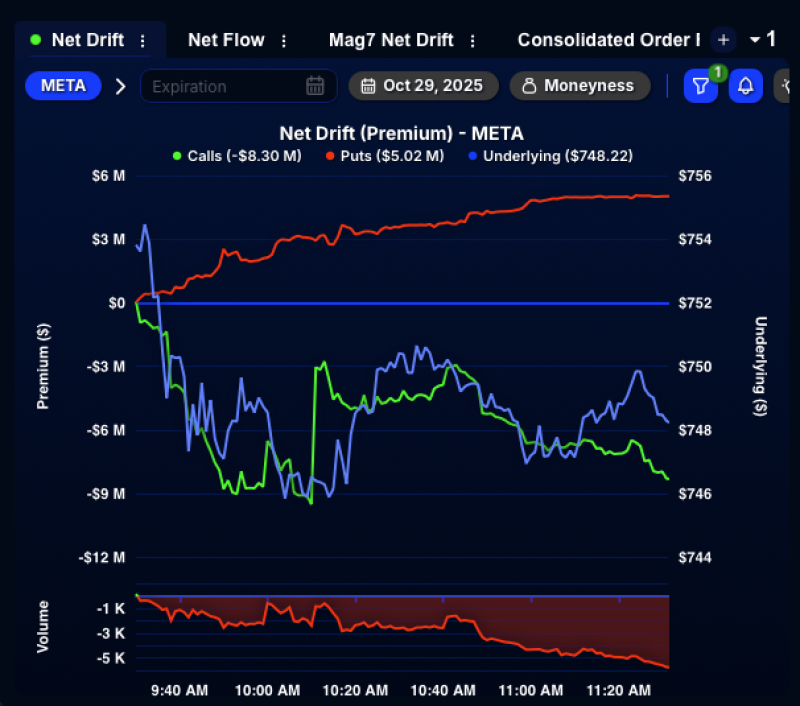

According to QuantData, over $8 million in call options were sold while $5 million in puts were bought—suggesting traders are bracing for potential downside.

The data visualization of META's Net Drift (Premium) tells the story in real time:

- Call Premiums (Green Line): Dropped by over $8 million throughout the session, showing traders unwinding bullish bets and losing confidence in upside potential.

- Put Premiums (Red Line): Climbed past $5 million, reflecting growing demand for downside insurance as earnings approached.

- Underlying Stock (Blue Line): META shares drifted lower from around $752 to $746, moving in sync with the bearish shift in options flow.

This divergence—falling calls, rising puts, and a softening stock price—points to traders hedging against disappointing results or cautious guidance from the company.

What Does It Mean?

The combination of heavy call selling and put buying usually signals one of two things: either traders are protecting profits from earlier long positions, or they're making outright bearish bets. Given the scale here—more than $13 million in combined repositioning—it looks more like risk management than aggressive speculation.

META is also testing key resistance near $755–$760, a level that's held price momentum in check lately. If earnings disappoint, that resistance could keep the stock capped.

Meta isn't alone. Across big tech, traders have been dialing back risk this earnings season amid valuation concerns and mixed signals from other major players. Implied volatility in META options has spiked too, which tells us the market expects a big move—one way or another—once the numbers drop.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets