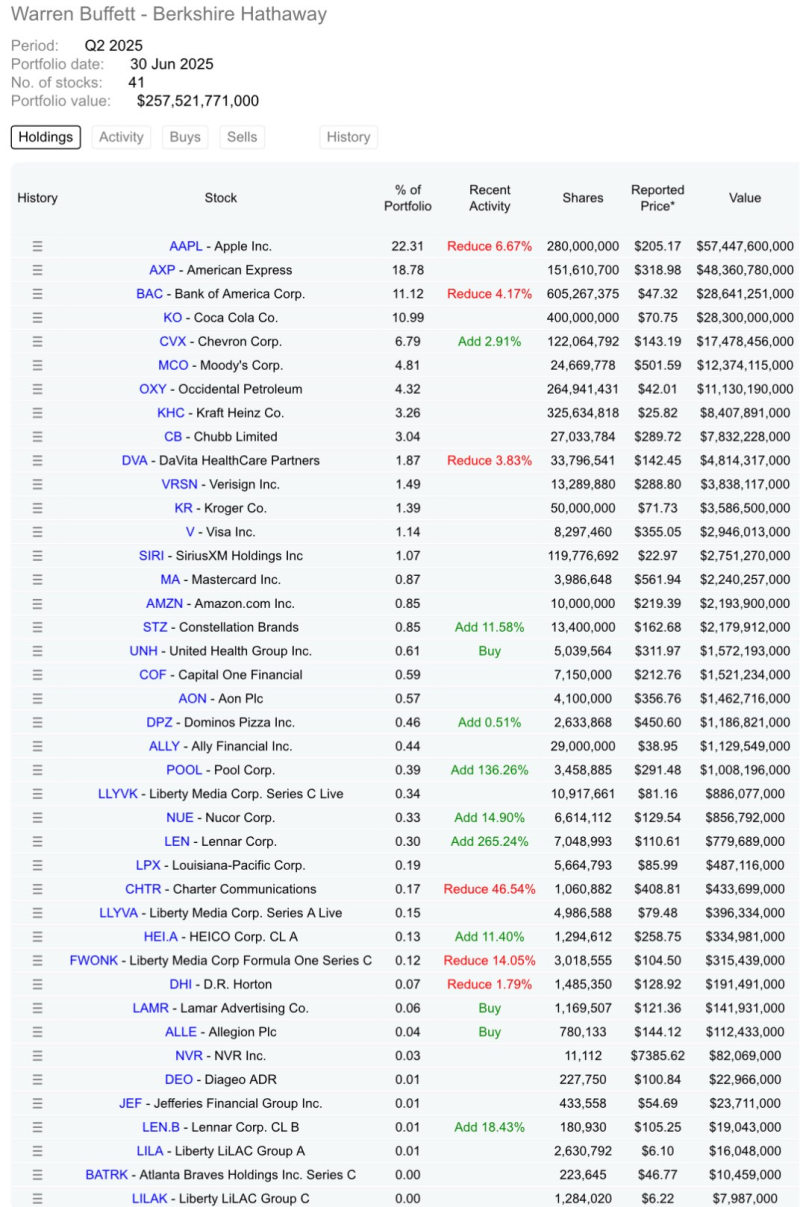

⬤ Berkshire Hathaway currently manages $257.5 billion spread across only 41 stocks, reinforcing its long-standing commitment to high-conviction investing. This concentrated structure shows Buffett's preference for betting heavily on his strongest picks rather than diversifying widely—a strategy that's defined his approach for decades.

⬤ New tax policy discussions create uncertainty for large investors like Berkshire. Proposed changes including higher capital-gains rates and taxes on unrealized gains could force portfolio adjustments and impact market stability. For smaller funds, these changes might prove overwhelming, while Berkshire's concentrated positions make it particularly exposed to regulatory shifts.

⬤ A $257 billion portfolio focused on just 41 stocks is exceptionally concentrated. This structure can amplify returns during strong markets but also increases exposure to sector-specific risks and policy changes. With heavy positions in companies like Apple, American Express, and Bank of America, tax reforms could directly affect Berkshire's strategy.

⬤ Despite inflation, interest-rate uncertainty, and regulatory changes, Berkshire's latest holdings confirm Buffett's unwavering commitment to deep conviction over broad diversification. The portfolio demonstrates that concentration paired with long-term discipline remains at the heart of his investment philosophy.

Usman Salis

Usman Salis

Usman Salis

Usman Salis