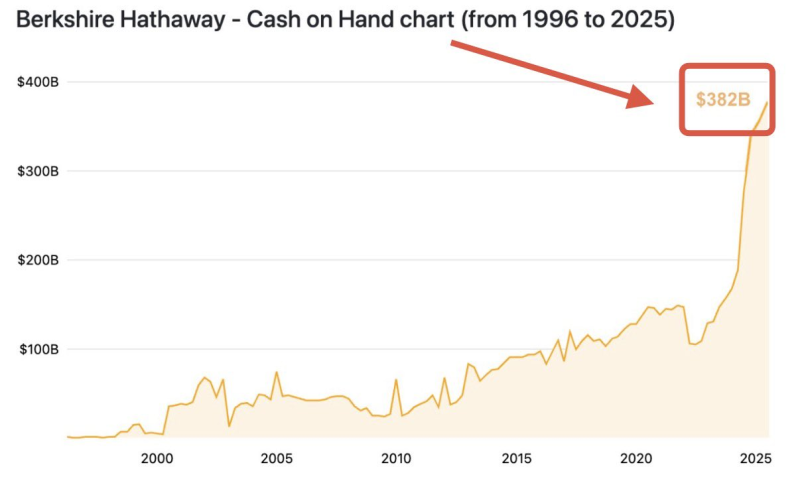

● Berkshire Hathaway just hit a major milestone: $382 billion in cash reserves, the most in company history. To put that in perspective, Buffett's cash pile is now bigger than the market cap of all but 30 companies worldwide.

● This massive stockpile reflects Buffett's trademark patience. He's clearly not rushing to chase today's hot tech and AI stocks. Instead, he's waiting for the right moment — when prices make sense and real value appears. It's classic Buffett: ignore the hype, wait for opportunity.

● Sure, holding that much cash has downsides. Inflation eats away at it, and idle money doesn't generate returns. But it also gives Berkshire serious firepower. When markets turn or distressed assets pop up, Buffett can move fast and big. That kind of liquidity is also a strong cushion against economic shocks, rate swings, or earnings slowdowns.

● The scale is wild: $382 billion exceeds the GDP of many mid-sized countries. As The Kobeissi Letter put it, "Warren Buffett's cash pile is now larger than the market cap of all but 30 public companies in the world. What is Buffett waiting for?"

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova