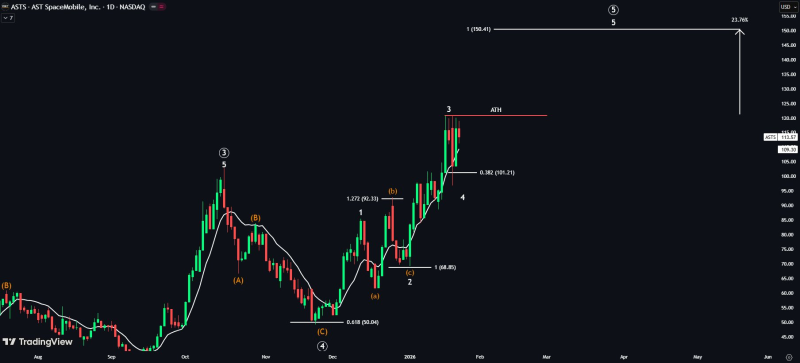

⬤ AST SpaceMobile stock is testing a critical price level as shares consolidate beneath all-time highs around $113–$115. The daily chart reveals strong momentum building underneath current prices, with the 21-day exponential moving average climbing steadily toward support. The rising trend line indicates that buyers are maintaining control even as the stock pauses near record territory.

⬤ Price action shows a clear resistance ceiling at the previous all-time high near $120. Multiple attempts to push higher have been turned back at this level, showing that sellers are still active at these elevated prices. However, the upward-sloping 21-EMA tells a different story—higher lows continue forming throughout the rally, suggesting this is a healthy consolidation rather than a distribution pattern. The stock is gathering strength rather than losing it.

⬤ The wave structure points toward a potential final leg higher, with analysts eyeing a Wave 5 scenario. A decisive break above $120 would confirm the continuation and activate the upside target near $150—roughly 23 percent above current levels. The chart also highlights a key support zone at $101, which matches the 0.382 retracement level where buyers have consistently stepped in during previous pullbacks.

⬤ This setup carries weight beyond just one stock. AST SpaceMobile has become a momentum leader, and how it handles this all-time high test could influence sentiment across high-growth names. A clean breakout would signal renewed strength, while continued rejection might extend the pause as support levels rise. With the trend structure intact and price holding above critical floors, the resolution of this technical battle should define ASTS direction in the near term.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova