Apple Stock's Bullish Pattern Is Detected

The shares of Apple, the largest tech company by market capitalization, have slowly been declining for the past few weeks. However, this is probably not the end of the bearish trend that has gripped the stock.

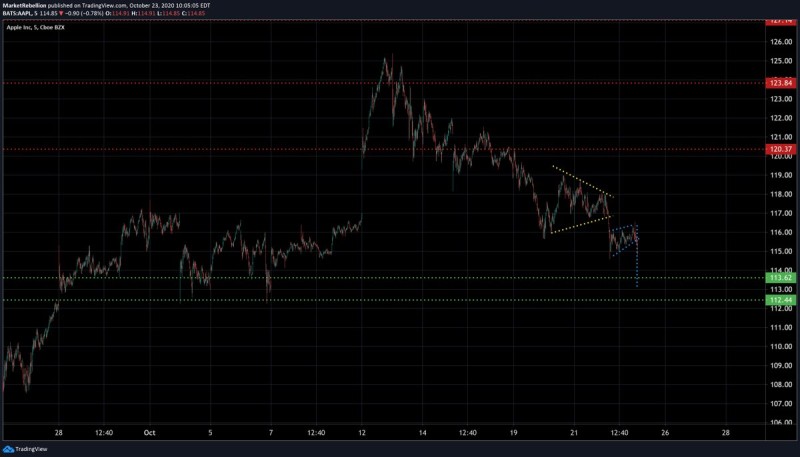

According to a technical analysis by the Market Rebellion portal, the stock will face another decline as a bearish wedge pattern has been recorded.

$AAPL - Bearish pattern active (wedge). Market Rebellion via Twitter

When the company's shares break through the support line of the emerging pattern, it will fall to the level of $113-114 per share. On the chart, at the analysts noted that the bearish wedge has been forming recently, which led to a drop in Apple's price to the current level of $115-116 per share.

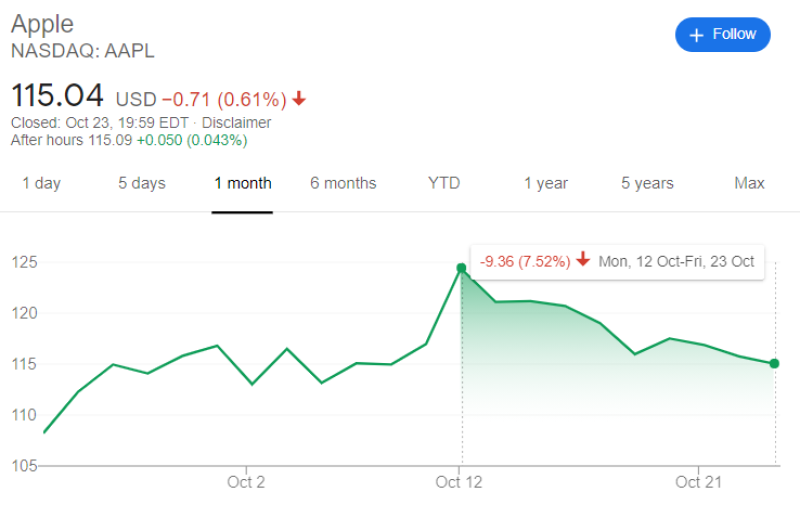

After a crazy bull rally in the summer that propelled the company to its second-in-history to hit a 2 trillion market cap, the market has not been overly supportive. Apple became one of the flagships of September's correction, having lost more than 16% in a few weeks relative to its all-time high price.

Apple's Slow Decline after Presenting the iPhone 12

Prior to the presentation of new products in October, the company's shares were able to add more than 6% in one day, but the day of the presentation itself and the ones that followed, completely neutralized this growth, since then the shares have decreased by more than 7.5%.

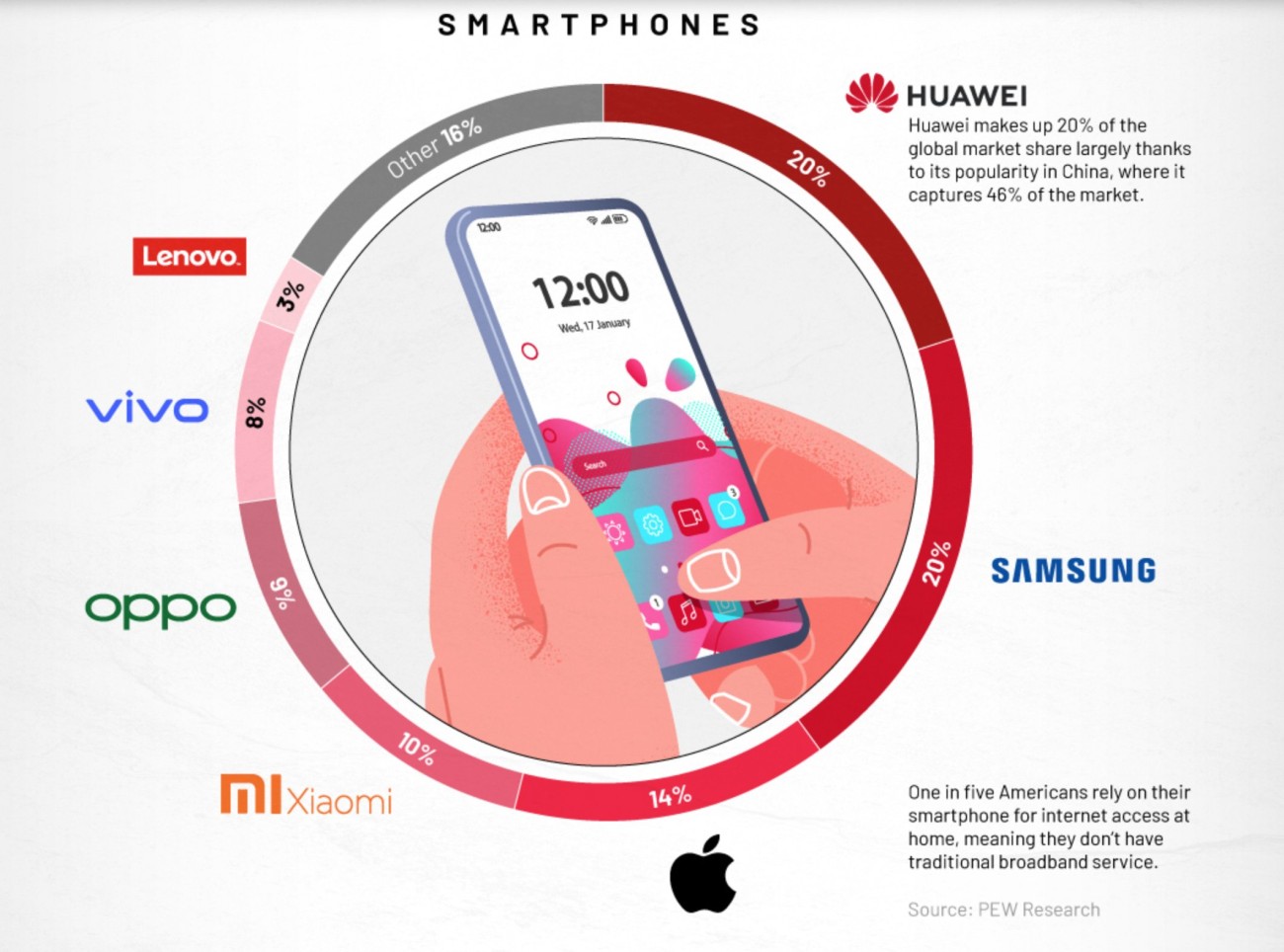

Nevertheless, the analysts are looking favorably on the long-term prospects of the company, given the release of the iPhone 12, the first smartphone to use innovative 5G technology. The next week is important for the company due to the publication of quarterly report, which will take place on October 29th.

Usman Salis

Usman Salis

Usman Salis

Usman Salis