The U.S. housing market is flashing warning signs again, and this time the concern is less about a sudden crash and more about a slow bleed that could stretch into 2027. A combination of high borrowing costs, a locked-in seller base, and near-historic affordability stress has sparked renewed debate about whether the market is sitting on another structural bubble, just like 2006.

Sellers Outnumber Buyers by 36% as Mortgage Rates Hold Near 6.5%

The numbers behind the warning are hard to ignore. Sellers now outnumber buyers by roughly 36%, while demand has dropped to levels last seen during the 2020 lockdowns. The 30-year fixed mortgage rate is sitting around 6.5%, and millions of existing homeowners are effectively anchored to the 3% rates they locked in during the pandemic era. That rate-lock effect is keeping supply artificially tight, because moving means giving up a historically cheap loan and stepping into a much more expensive one.

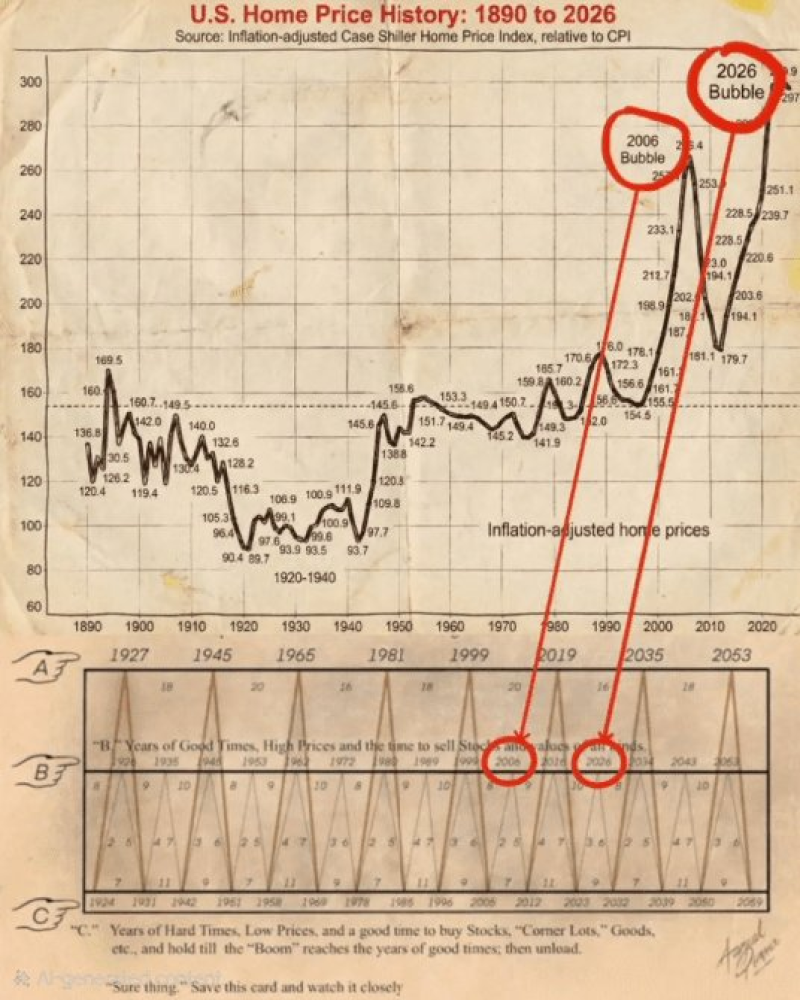

An inflation-adjusted Case-Shiller home price chart covering 1890 to 2026 puts the current situation in sharp perspective. Prior cycle peaks are clearly labeled, including the 2006 bubble top. And right at the upper end of the entire 130-year series, the chart flags a "2026 Bubble" zone, suggesting real home prices today are not just elevated, they are historically stretched.

Why 2026 to 2027 Is the Key Risk Window for a Housing Reset

The core problem, as the commentary frames it, is not which direction prices move, but the cost of simply holding. U.S. housing affordability is already at record lows, and with leverage at 5:1 and financing costs near 6.5%, even a flat market quietly erodes returns. The result is a market where "no real price discovery" is happening, because neither side has enough pressure to move.

With 5:1 leverage at 6.5%, holding costs can bleed capital if prices stay flat, because the financing burden stays high while upside is capped by affordability.

A more meaningful reset is being framed as a 2026 to 2027 risk window, contingent on whether forced selling increases enough to break the standoff. If it does, home prices that already hit all-time highs in 2025, surpassing the 2006 bubble peak, could face genuine downside pressure rather than just sideways grinding. Housing is a central pillar of U.S. consumer balance sheets and credit conditions. Prolonged illiquidity does not just hurt homebuyers, it amplifies broader financial stress when conditions eventually shift.

Usman Salis

Usman Salis

Usman Salis

Usman Salis