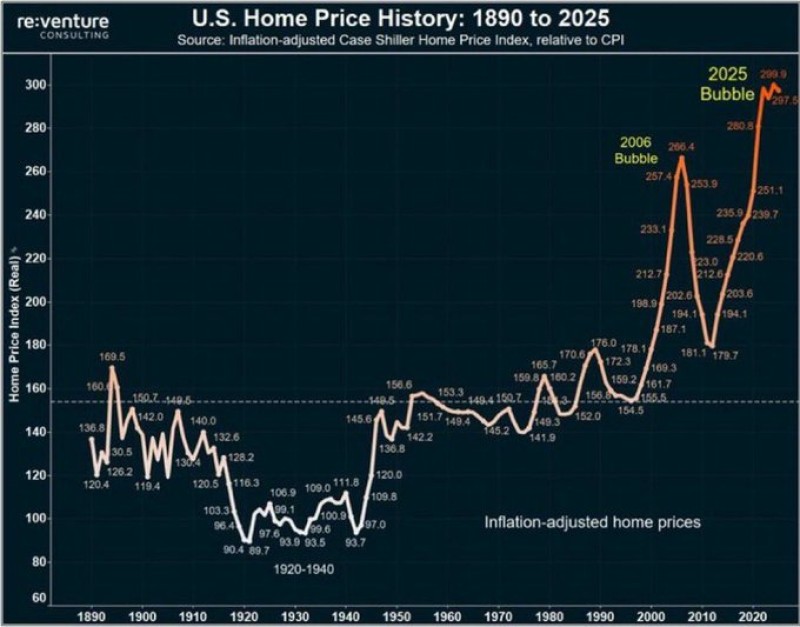

The U.S. housing market is once again flashing warning signs. Inflation-adjusted home prices have reached unprecedented levels, surpassing even the 2006 housing bubble. This analysis, paired with a tweet highlighting the historic surge, is sparking serious concern among investors, homeowners, and economists.

Inflation-Adjusted Home Prices Reach Historic Peak

U.S. home prices adjusted for inflation have soared to a new record of 299.9 in 2025, surpassing the previous peak of 266.4 during the 2006 housing bubble. The analysis is based on the Case-Shiller Home Price Index relative to CPI, tracking real estate trends from 1890 to present.

This new milestone comes amid growing concerns about housing affordability across the country. The price surge reflects a nearly 70% jump from pre-2020 levels, making it the steepest climb in modern history.

Housing Affordability Crisis Intensifies

Despite rising mortgage rates and inflationary pressures, the market has shown no signs of cooling. Real home prices have more than doubled since 2012, and the 2025 spike places prices nearly 80% above the long-term historical average.

Economists warn that such rapid price escalation may increase economic fragility, especially for first-time homebuyers. While not all analysts agree it's a "bubble," the chart's trajectory echoes the steep rise leading up to the 2008 crisis.

Conclusion

As Americans celebrate Independence Day, many face the irony of a housing market increasingly out of reach. With inflation-adjusted prices at historic highs, the dream of homeownership is drifting further away for millions.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah