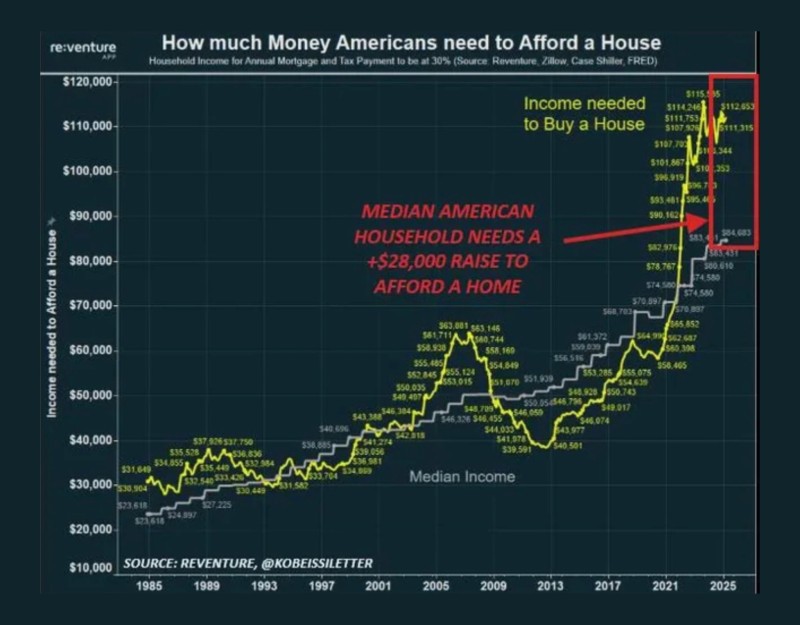

Buying a home in America has become harder than ever before. Recent data shows the median U.S. household would need an additional $28,000 per year just to afford an average home. This represents the widest affordability gap in history, where restoring 2019-level affordability would require either a 38% drop in home prices or a 60% surge in household incomes.

A Historic Gap Between Income and Housing Costs

The latest analysis compares median household income with the income required to afford a home, assuming 30% of income goes toward mortgage and taxes. For decades, these two measures moved roughly together. However, after the 2020 monetary expansion, the gap exploded dramatically. As trader Carl ₿ Menger points out, by 2025, households needed over $115,000 annually to buy a home, while median income remained under $90,000.

This mismatch represents the worst affordability crisis on record, demonstrating how rapidly housing prices have outpaced wage growth.

Why Affordability Collapsed

Several factors created this housing crunch. Federal Reserve policy played a major role through ultra-low rates and liquidity injections during 2020-2021, which boosted asset prices, particularly real estate. Supply shortages from limited housing stock and restrictive zoning kept demand elevated while rising mortgage rates from the Fed's tightening cycle drove up borrowing costs. Meanwhile, household income growth lagged far behind housing inflation, creating a perfect storm that locked younger generations out of homeownership.

Bitcoin as a Generational Hedge?

This crisis connects to Bitcoin as a potential hedge for younger Americans against asset inflation. While volatile, BTC has dramatically outperformed both housing and equities over the past decade, making it increasingly attractive for those priced out of traditional assets. Many view cryptocurrency as an alternative store of value when conventional wealth-building paths become inaccessible.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah