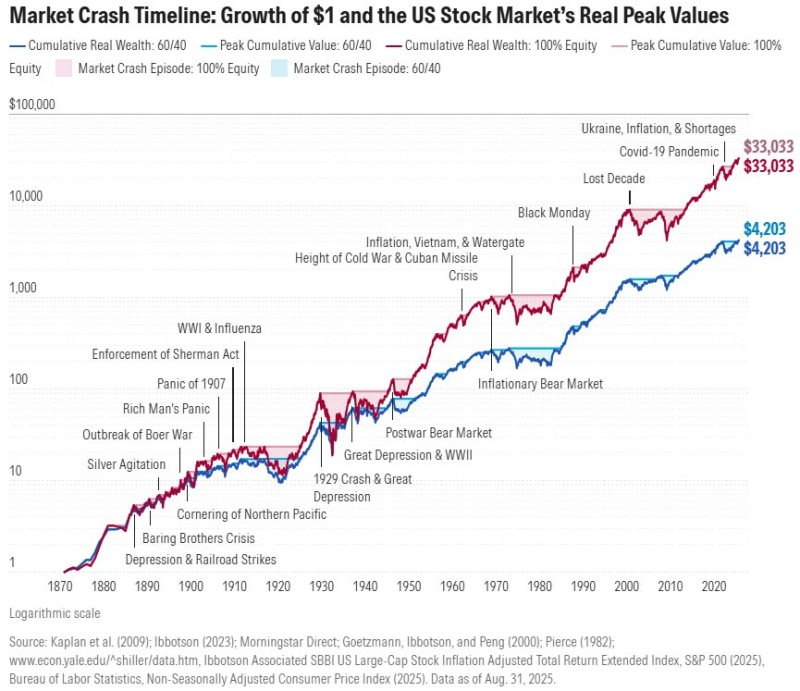

⬤ Long-term investing comes down to a simple truth: there's always a reason to sell, but countless reasons to stay in the market. Historical data tracking U.S. markets since the late 1800s proves this point dramatically. A single dollar invested in equities has grown to over $33,000 through 150+ years of economic turbulence—surviving the 1907 Panic, Great Depression, two World Wars, 1970s inflation, the 2008 financial crisis, COVID-19, and recent volatility. Even a balanced 60/40 portfolio reached more than $4,200, showing how sustained market participation beats timing attempts.

⬤ Recent policy discussions around capital gains taxes, retirement account changes, and portfolio surtaxes have raised concerns about impacts on long-term investing. Higher tax burdens could discourage multi-year equity holdings, increase costs for smaller advisory firms, and potentially drive financial talent to more favorable jurisdictions. These proposals underscore why policy stability matters for investors counting on compound growth strategies.

⬤ The evidence is clear: market downturns are inevitable but temporary, while long-term equity exposure consistently delivers exceptional results. This is exactly why broad-market ETFs like VOO remain popular—they offer simple, diversified access to the wealth-building power of sustained market participation. Every major crash in history has been followed by recovery and new highs.

Usman Salis

Usman Salis

Usman Salis

Usman Salis