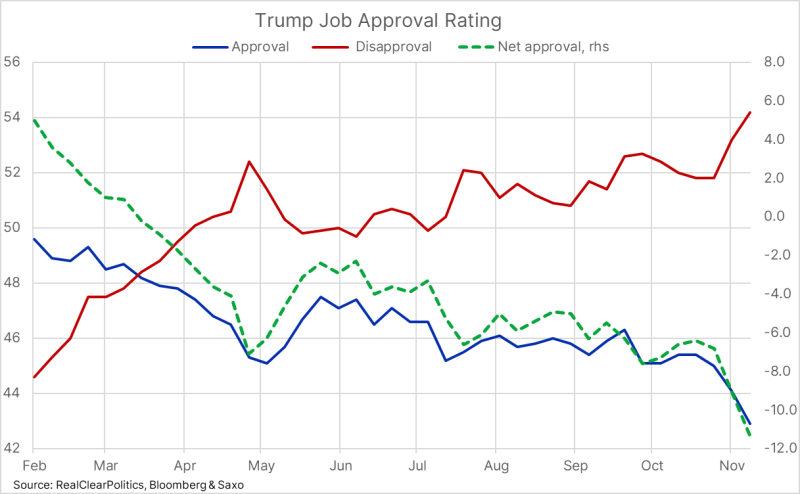

⬤ Trump's approval rating keeps sliding, with disapproval rising and net approval turning increasingly negative. Now he's proposing something unexpected: tariff dividend payments of "at least $2,000" to all households except high earners. It's a bold economic move that arrives at a politically vulnerable moment, seemingly designed to win back voters worried about their finances and economic uncertainty.

⬤ Markets reacted sharply because the fiscal math is concerning. Funding these recurring payments through higher import tariffs could push federal debt even higher—especially problematic when borrowing is already elevated. The tariffs themselves would hit import-dependent businesses hard, raising bankruptcy risks for smaller companies and undermining supply chain competitiveness. Add in the inflationary pressure from both higher tariffs and direct cash transfers, and you've got a recipe for long-term economic instability.

⬤ Analysts see this clearly. The plan risks worsening the federal debt trajectory while adding upward pressure to inflation—which helps explain today's renewed rally in hard assets like silver, gold, platinum, and copper. When political uncertainty meets fiscal risk, investors turn to tangible stores of value.

⬤ With political pressure mounting and markets scrutinizing every policy proposal, the combination of falling approval ratings and controversial fiscal plans is reshaping expectations around inflation, debt, and where money should go. Commodity markets are feeling it most as fiscal risk and political volatility become the dominant forces heading into the coming months.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi