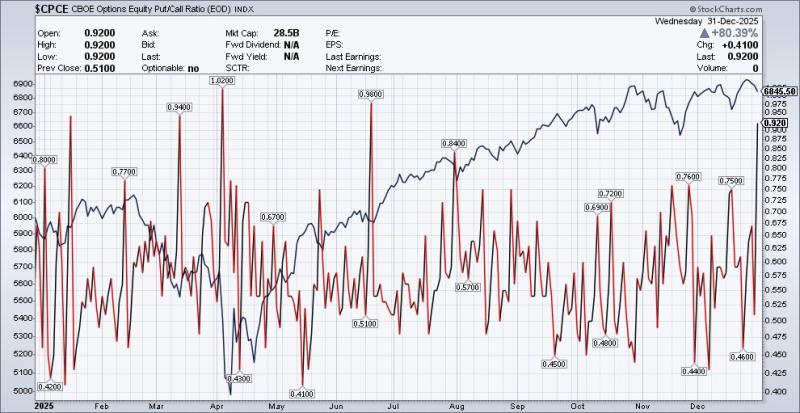

⬤ The S&P 500 Index (SPX) wrapped up 2025's final trading session with a bearish close while the CBOE equity put/call ratio surged to 0.92 on December 31. This marked the indicator's highest reading since June and represented a dramatic jump from the previous session's 0.51 level. The SPX was trading around the 6,846 area as put/call readings spiked sharply into year-end.

⬤ The equity put/call ratio tracks put option volume relative to call option volume — higher readings typically signal increased hedging activity or bearish speculation. Throughout 2025, the ratio showed significant swings, including earlier peaks around 1.02 in April and 0.98 in August. The latest 0.92 reading stands out after several months of lower numbers, with December levels hovering between 0.40 and 0.50 before this year-end surge. Market observers are viewing this spike as a technical development rather than one driven by any specific fundamental catalyst.

⬤ Despite Wednesday's bearish close, index futures suggested the SPX might avoid printing a lower low in the following session. Historical chart data shows that previous put/call ratio spikes often aligned with periods of market stress or moments when investor sentiment turned more cautious. Still, the SPX's broader price trend continued showing an upward trajectory throughout the year, despite occasional corrections and volatility.

⬤ This matters because the SPX serves as a crucial benchmark for U.S. equities, and shifts in the equity put/call ratio can reveal changes in market sentiment and risk appetite. A sharp rise to levels not seen in six months may indicate growing demand for downside protection or increased bearish positioning. How the SPX performs following this spike will help determine whether it's just a brief moment of caution or signals a broader reassessment of equity market risk heading into 2026.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah