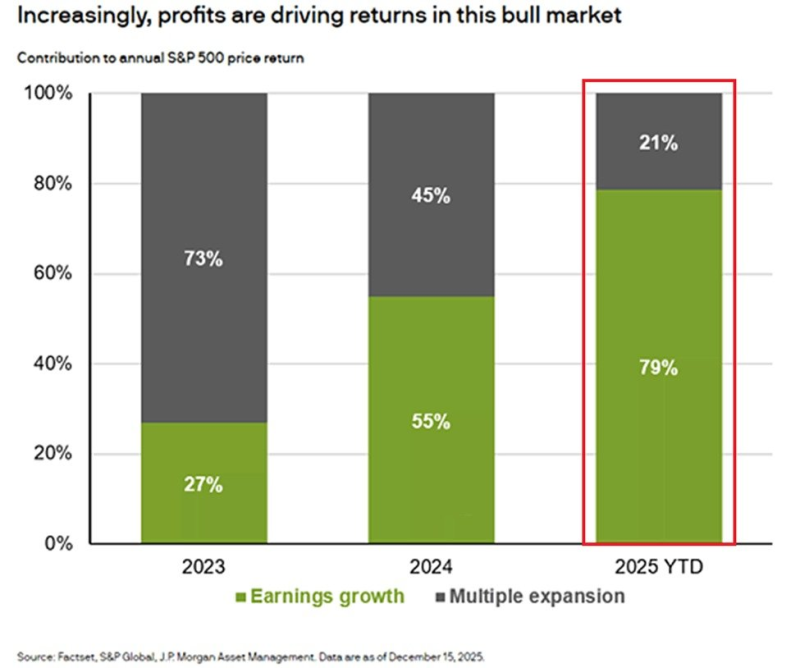

⬤ The S&P 500 rally this year is running on actual company profits way more than rising valuations. Fresh numbers show earnings growth is behind 79% of the index's gains so far in 2025, while multiple expansion accounts for just 21%. This means the market is increasingly relying on real business performance rather than investors simply paying higher prices for the same earnings.

⬤ The shift becomes obvious when you look at the past couple years. In 2024, earnings drove 55% of SPX returns while multiple expansion made up 45%. Back in 2023, it was almost flipped—only 27% came from earnings and 73% from valuation jumps. Compared to last year, the earnings contribution has jumped 24 percentage points, and it's nearly tripled since 2023. The trend is clear: fundamentals are taking over.

⬤ That remaining 21% of gains this year reflects higher market valuations. It's a much smaller piece than the 45% in 2024 or the massive 73% in 2023, showing how the market's return profile has fundamentally changed. The momentum now has better "quality" because it's backed by actual revenue and profit growth rather than just sentiment.

⬤ This matters for where stocks go next. When the S&P 500 is rising mostly on earnings rather than expanding price-to-earnings ratios, it means the rally has sturdier support underneath it. Corporate performance is doing the heavy lifting, which typically signals a healthier market environment than one driven purely by speculation and valuation inflation.

Peter Smith

Peter Smith

Peter Smith

Peter Smith