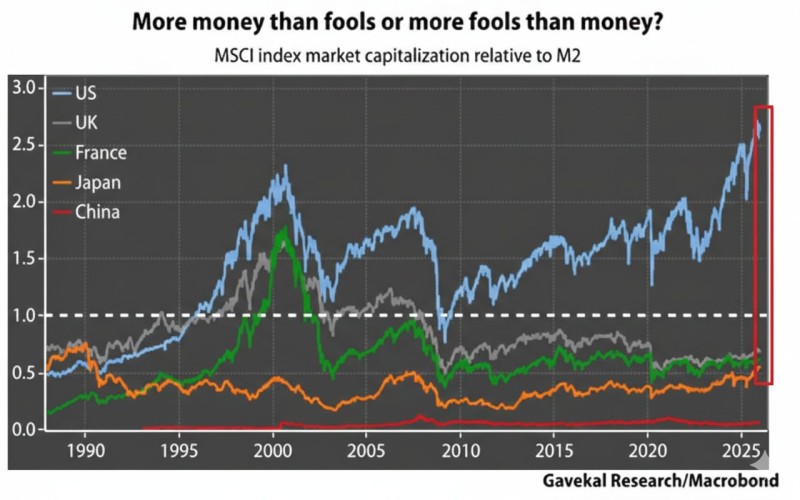

The U.S. stock market has entered uncharted territory. American equities are now trading at levels that dramatically outpace the actual money flowing through the economy, creating a gap that's never been seen before in modern financial history. This disconnect between stock prices and liquidity raises important questions about market sustainability and future direction.

U.S. Stocks Hit 270% Premium Over Money Supply Growth

American equities have pulled away from broad money growth in what's becoming an increasingly isolated rally compared to other major economies. According to analysis from Coin Bureau, the gap between U.S. stock prices and the M2 money supply has surged to approximately 270%, marking the highest reading ever recorded on charts tracking MSCI market capitalization relative to M2.

This isn't just a small deviation—it's a massive structural shift. The visual comparison puts this in stark perspective: while the U.S. line climbs toward the 2.7 level, the UK, France, and Japan remain clustered near roughly 0.6, showing that America's stock market is in a league of its own.

How the Gap Expanded to Historic Levels

The divergence didn't happen overnight. The data reveals a steady acceleration: the gap has expanded roughly 120 percentage points since 2022 alone, about 75 percentage points since the 2008 financial crisis, and around 40 percentage points above the dot-com era peak. It also stands roughly 20 percentage points above the recent all-time high in the dataset.

The chart frames a situation where pricing moves ahead of existing liquidity conditions.

This pattern has developed even as the Federal Reserve has taken steps to manage liquidity. Recent macro coverage has focused heavily on these conditions, including discussion about the Fed adding liquidity through repo operations in Fed pumps $29.4B into banks in biggest liquidity move since dot-com era.

What This Means for Markets and Liquidity

The widening gap suggests that stock valuations are increasingly disconnected from the underlying money available in the financial system. Related macro discussion has also appeared in coverage of record expansion in the U.S. money supply in US M2 money supply hits record $22.2 trillion.

Broader commentary around policy expectations has surfaced in analysis of Treasury buyback impact on markets in US Treasury debt buyback sparks market optimism, highlighting how liquidity narratives continue to shape macro market interpretation and investor sentiment across asset classes.

The question now facing investors: can stocks sustain these elevated levels, or does this historic divergence signal a coming correction?

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov