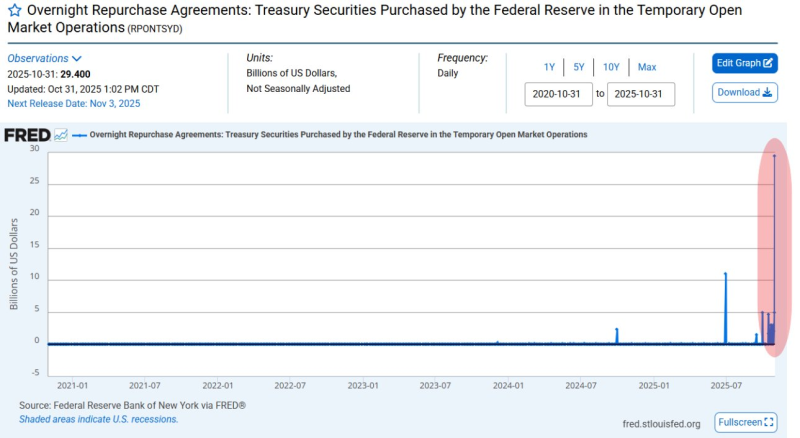

● According to Barchart, the Fed just made its biggest liquidity push since the early 2000s, pumping $29.4 billion into the banking system via overnight repurchase agreements on October 31, 2025. Data from the New York Fed's FRED platform shows this operation dwarfs anything we've seen in two decades — even surpassing peak levels during the Dot-Com bubble.

● Overnight repos let banks swap Treasury securities for quick cash when they need immediate funding. This massive spike suggests banks are facing real pressure to cover short-term obligations — likely tied to month-end balance sheet adjustments or sudden demand for Treasury collateral.

● What makes this notable isn't just that repos happen — they're a standard Fed tool — but the size and timing. After years of minimal repo activity, a $29.4 billion injection stands out.

● Historically, sudden jumps in Fed repo operations signal stress. We saw it in 2019 when the repo market seized up, and before the early 2000s downturn. Banks typically tap this facility when they hit temporary funding gaps or when Treasury market turbulence disrupts normal liquidity channels.

Usman Salis

Usman Salis

Usman Salis

Usman Salis