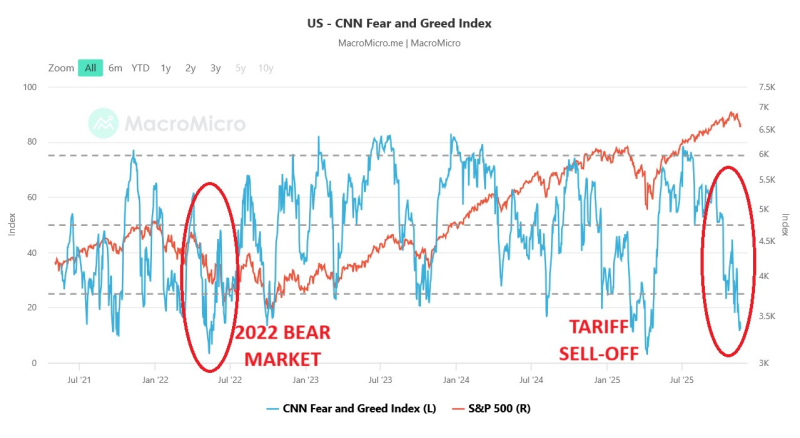

⬤ The US stock market's sentiment gauge is flashing red. CNN's Fear & Greed Index just crashed to 7 points, marking one of the most dramatic sentiment collapses in years. This is the lowest reading since April's tariff-fueled sell-off, when the index bottomed out at 3 points. What makes this especially wild is that the S&P 500 is still hanging around near record highs—creating a weird disconnect between price and sentiment.

⬤ Looking at the historical data, the index has only hit these extreme fear levels a handful of times recently. During the 2022 bear market, it dropped to 3 points during the worst of the downturn. Now sitting at 7, we're back in that same danger zone where investors are seriously spooked. The chart flags both the 2022 crash and April's tariff panic as moments when extreme fear lined up with major market stress—and we're seeing similar vibes right now.

⬤ Here's the kicker: while the S&P 500 keeps grinding near multi-year highs, sentiment has absolutely tanked. Historically, when the Fear & Greed Index swings this hard, volatility tends to spike not long after. The recent sentiment collapse, clearly marked on the chart, points to growing uncertainty about the economy and policy risks—even though prices haven't cracked yet. Risk perception is shifting way faster than actual market movement.

When sentiment approaches zones previously associated with major market sell-offs, conditions tend to become more reactive to new catalysts.

⬤ Why does a 7-point reading matter? Because extreme sentiment levels like this tend to make markets way more jumpy and sensitive to any new headlines—whether economic data, Fed moves, or policy surprises. When the index drops this low, it's basically a warning sign that participants are on edge. With sentiment now matching the worst levels since 2022, the big question is whether things stabilize from here or if we're heading into even choppier waters ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis