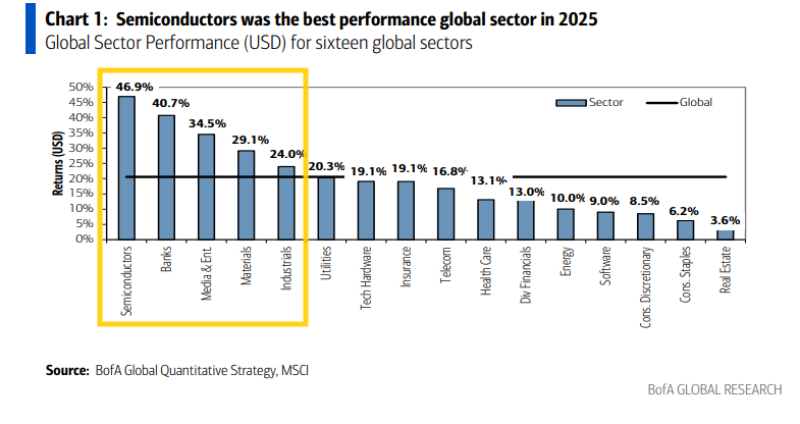

⬤ Semiconductors absolutely crushed it in 2025, topping every other sector globally with a 46.9% return, according to fresh Bank of America data. That's more than double the 20.6% gain posted by the broader MSCI AC World Index. The sector's dominance reflects relentless demand tied to AI infrastructure buildout, advanced computing needs, and chip supply chain expansion. NVDA and other chip manufacturers rode this wave, attracting massive capital flows into the technology supply chain.

⬤ Banks claimed second place with a solid 40.7% return. Media and Entertainment followed at 34.5%, Materials at 29.1%, and Industrials at 24.0%—all clearing the global index benchmark. This widespread strength across economically sensitive sectors painted a picture of broad-based growth. Mid-tier performers included Utilities, Technology Hardware, Insurance, and Telecom, which delivered returns between 16% and 21%. Healthcare and Diversified Financials lagged slightly in the low-to-mid teens.

⬤ The bottom of the pack tells a different story. Energy managed only 10%, while Software squeaked out 9%. Consumer Discretionary and Consumer Staples returned 8.5% and 6.2% respectively. Real estate hit rock bottom at just 3.6%, suffering from elevated financing costs and ongoing valuation pressures across global property markets. The gap between innovation-driven sectors like semiconductors and defensive or rate-sensitive areas couldn't be more stark.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah