⬤ The world's biggest central banks aren't done shrinking their balance sheets just yet. While the US Federal Reserve wrapped up its quantitative tightening cycle, the European Central Bank, Bank of England, and Bank of Japan are gearing up to pull roughly $1.2 trillion from their combined balance sheets in 2026. This coordinated move represents one of the most aggressive liquidity withdrawals we've seen in recent history.

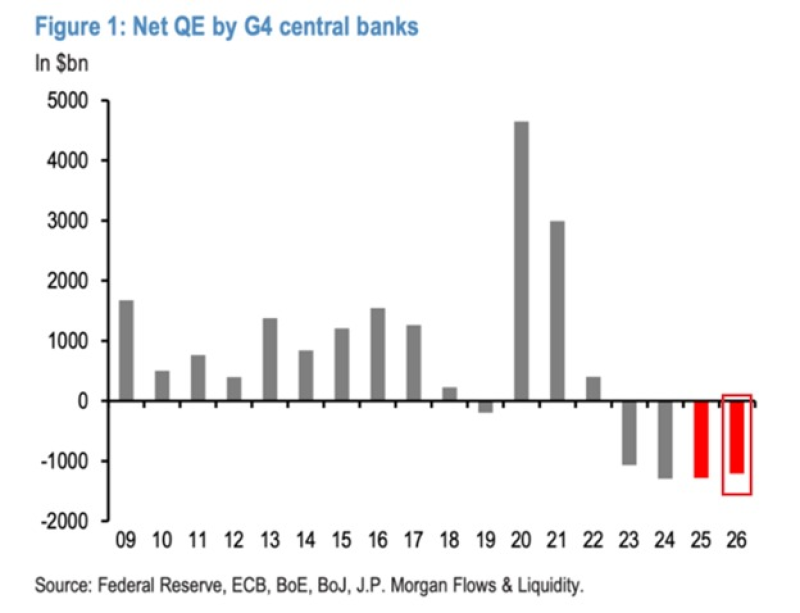

⬤ The numbers tell the story clearly. G4 central bank assets dropped about $1.4 trillion in 2024, with another $1.3 trillion expected to disappear by the end of 2025. Net quantitative easing has flipped decisively into negative territory, and the runoff at the ECB and BoJ is picking up enough speed to nearly match what the Fed was doing before it stopped on December 1.

⬤ To put this in perspective, think back to 2020 and 2021 when these same central banks pumped roughly $7.7 trillion into the financial system to keep things from falling apart. If current forecasts hold, they'll have unwound about $5.0 trillion of that between 2023 and 2026—that's around 65 percent of the entire pandemic stimulus package.

This places the current balance sheet contraction among the largest synchronized liquidity withdrawals in modern monetary history.

⬤ For gold investors, this liquidity drain matters. Ongoing balance sheet reduction affects everything from real yields to overall market sentiment and risk appetite. As central banks keep tightening the screws on their normalization plans, how global liquidity moves will likely stay front and center in determining where gold heads next.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah