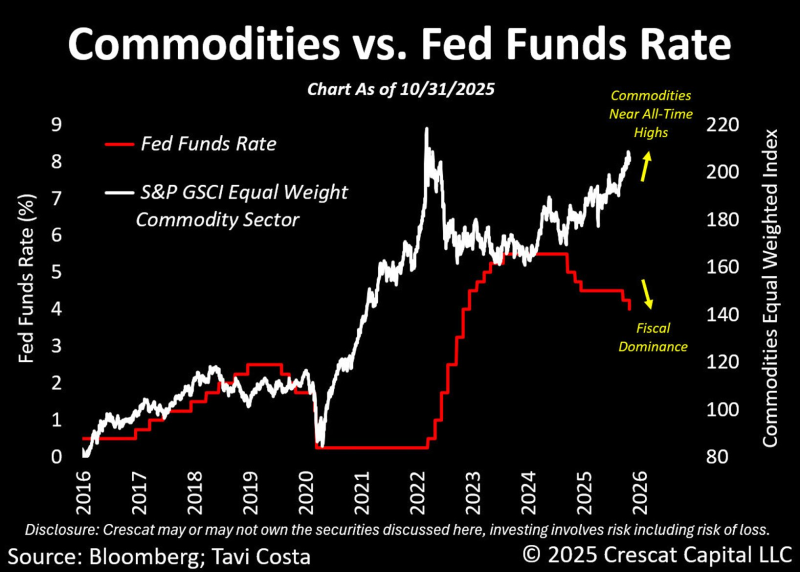

⬤ Commodities are climbing toward record territory as the Federal Reserve starts cutting rates. Recent analysis shows that as markets keep sliding and economic data weakens, lower interest rates are becoming more likely. The latest chart reveals a developing feedback loop where easier policy conditions line up with a stronger argument for financial repression, proving that hard assets have held up well through all the recent market chaos.

⬤ The data compares the Fed funds rate against the S&P GSCI Equal Weight Commodity Index. While the Fed funds rate has dropped from peaks above 5 percent, commodities have been getting stronger, pushing toward the 200-to-220 range that's being called "near all-time highs." The chart labels this downward move in interest rates as "Fiscal Dominance," hinting at policy pressure driven by bigger fiscal forces at play.

Continued downside in markets and signs of economic weakening make lower rates even more inevitable. The volatility is actually helpful during these macro transitions.

⬤ Looking at the history, commodities have surged during past periods when interest rates either flatlined or fell—especially during the post-2020 cycle and heading into 2025. The latest jump in commodity prices comes right after a brief dip, showing how these assets can bounce back strongly from volatility and keep pushing higher as policy eases up.

⬤ The connection between falling rates and rising commodity prices matters because it shows how big economic shifts can mess with both inflation expectations and where money flows. When you've got a weakening economy paired with the Fed easing up on rates, it changes how investors feel and pushes capital into hard assets. With commodities nearly hitting historic peaks while the Fed funds rate slides down, we're seeing the real impact of fiscal pressures, rate expectations, and shifting market dynamics on the resource sector.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi