⬤ The U.S. labor market is showing serious cracks. New ADP data reveal private employers have been cutting jobs at the fastest pace since 2020, with an average of 11,250 jobs lost per week over the four weeks ending October 25th. That adds up to a total drop of 45,000 jobs—the second-largest decline since the pandemic started.

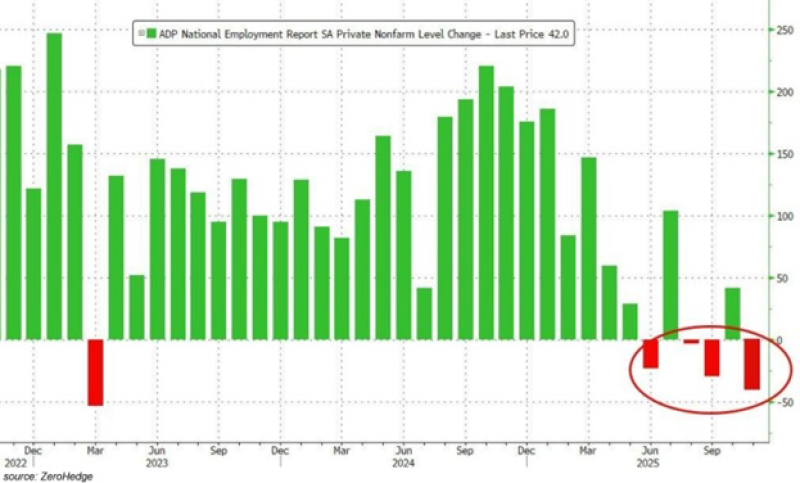

⬤ Interestingly, ADP's monthly report told a different story, showing a gain of 42,000 jobs in October after two months of losses. This mismatch highlights growing volatility in labor data. The ADP chart paints a clearer picture: after steady growth earlier in the year, job creation has tanked through mid-2025, with multiple months now showing outright contraction in private-sector hiring.

⬤ If this slide continues, the economy could be in trouble. Higher interest rates, weaker consumer spending, and ongoing corporate cost-cutting are all weighing on hiring. Persistent job losses could lead to rising unemployment and stagnant wages—forcing the Federal Reserve to rethink its current stance on keeping rates elevated.

⬤ The weakness isn't limited to one sector. Manufacturing, retail, and professional services are all feeling the pinch. Goldman Sachs estimates private payrolls actually fell by around 50,000 in October, contradicting ADP's headline number. The gap between these figures has economists wondering if the job market is cooling faster than anyone expected.

⬤ With both ADP and Wall Street pointing toward slowing employment, it looks like the U.S. job market might be entering a new phase of deceleration. If upcoming Bureau of Labor Statistics data confirm this trend, it could shift expectations for rate cuts in 2026—and challenge how long the Fed can stick with its "higher-for-longer" approach.

Peter Smith

Peter Smith

Peter Smith

Peter Smith