⬤ The Federal Reserve's path toward easier monetary policy is running into a problem: inflation isn't cooperating. Markets rallied hard on expectations the Fed would tolerate higher inflation and deliver rate cuts in 2025. But private sector data reveal prices are still climbing steadily, creating a disconnect between what investors are pricing in and what the economy is actually doing. If the Fed hesitates—and the data suggest it should—the rally could lose steam fast.

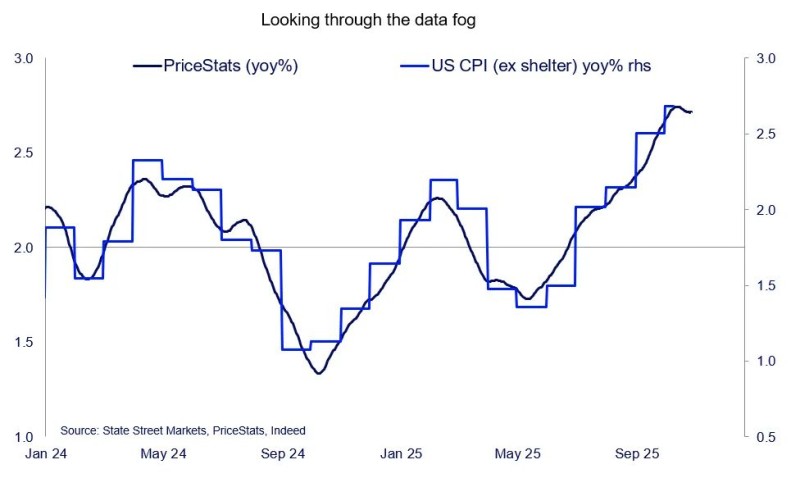

⬤ Recent charts using PriceStats and Indeed data show inflation trending toward 3% year-over-year, well above the Fed's 2% target. Both PriceStats and CPI excluding shelter have been moving higher through 2025, signaling that real-time price pressures remain stubborn. This contradicts earlier hopes that disinflation was back on track and rate cuts were just around the corner.

⬤ Markets have already priced in multiple rate cuts for this year, betting the Fed will stay patient. But if inflation stays elevated and the central bank pulls back on easing, risk assets could get hit hard. Growth stocks and leveraged real estate—sectors that thrive on cheap money—are especially vulnerable. A prolonged inflation problem could also delay any return to normal policy, keeping uncertainty high across both bond and equity markets.

⬤ The takeaway: private inflation data are flashing warning signs that official CPI reports might be understating. The Fed's tolerance is about to be tested, and policymakers will have to choose between keeping markets happy and actually controlling inflation. Right now, it looks like the much-hyped easing cycle may arrive later and more cautiously than Wall Street is hoping for.

Peter Smith

Peter Smith

Peter Smith

Peter Smith