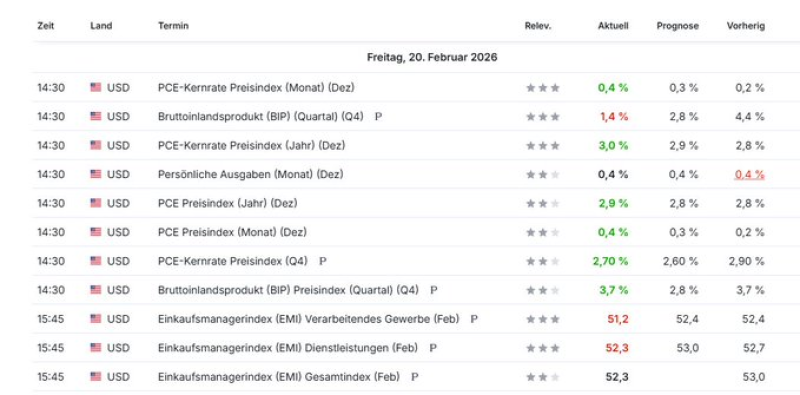

⬤ The final macro picture for late 2025 was a study in contrasts. The PCE Price Index rose 0.4% month over month in December, above the 0.3% forecast, with the year-over-year pace printing at 2.9% versus the 2.8% expected. Core PCE inflation, which strips out food and energy, also climbed 0.4% on the month and hit 3.0% annually, topping the 2.9% forecast and marking the highest reading in months. As @der_rentner_yt noted, the numbers came in hotter than the market had penciled in.

⬤ On the growth side, things looked noticeably softer. U.S. GDP expanded at just a 1.4% annualized rate in Q4, well below the 2.8% forecast and a sharp drop from the prior 4.4% reading. Full-year 2025 growth came in at 2.2%, weaker than 2024, pointing to an economy that is losing momentum even as prices stay sticky. The GDP price index for Q4 printed at 3.7%, a reminder that inflation is still woven into the broader output story.

⬤ Put the two together and the policy tension becomes clear. With inflation above Fed target and growth slipping, the room to maneuver narrows fast. A 3.0% core PCE reading leaves little space for rate cuts, while a 1.4% GDP print makes aggressive tightening equally uncomfortable. That squeeze is exactly what keeps FX and rates markets on edge ahead of every inflation and activity release, and why the stagflation debate is not going away anytime soon.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova