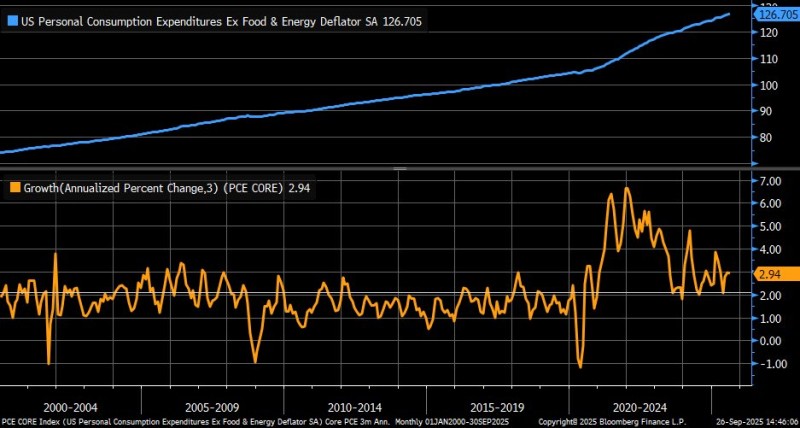

The latest inflation data confirms that price pressures remain stubborn in the US economy. The Core Personal Consumption Expenditures (PCE) Price Index—which excludes food and energy costs - rose at a 2.9% annualized pace over the past three months. This reading highlights that inflation is moderating from its pandemic-era extremes but has yet to settle near the Federal Reserve's 2% target.

Inflation Still Elevated in August

The blue line shows the Core PCE Index steadily trending higher since 2000, reaching 126.705 in August 2025. The steepening slope after 2020 reflects persistent inflation pressures in the post-pandemic environment. The orange line tracks the 3-month annualized growth rate, currently at 2.94%. While far below the surges of 2021–2022, when growth spiked above 6%, the figure remains elevated compared to pre-pandemic averages of 1%–2.5%. Market strategist Liz Ann Sonders emphasized that the PCE data reflects ongoing inflationary momentum, reinforcing the Fed's challenge in balancing growth with price stability.

The chart also shows a marked increase in volatility since the pandemic, with sharp fluctuations replacing the relatively stable patterns seen during the 2000s and 2010s. This reflects the impact of supply chain shocks, fiscal stimulus, and shifting consumer behavior.

What's Keeping Inflation Sticky?

Several factors continue to prop up price levels:

- Strong Consumer Spending: Resilient demand continues to support higher prices

- Labor Market Pressures: Solid wage growth keeps service-sector inflation elevated

- Housing Costs: Shelter inflation remains sticky, slowing broader disinflation

- Energy Spillovers: Although excluded from Core PCE, energy volatility indirectly influences overall costs

What's Next for Inflation?

The August Core PCE reading suggests that while inflation has cooled significantly from its pandemic-era highs, it remains above the Fed's comfort zone. Policymakers face a difficult balancing act: tightening policy further risks slowing growth, while loosening prematurely could reignite inflationary pressures. For investors, the message is clear—the Fed's fight against inflation isn't over yet, and restrictive monetary policy is likely to stick around well into 2026.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah