American inflation isn't rising anymore, but it's not falling either. The latest CPI and PCE numbers show prices stuck just above the Federal Reserve's 2% target, creating an awkward situation now that the Fed has already started cutting rates.

What the Numbers Show

Market analyst Capital Flows recently highlighted what the data makes clear: Core CPI and Core PCE have essentially flatlined above where policymakers want them.

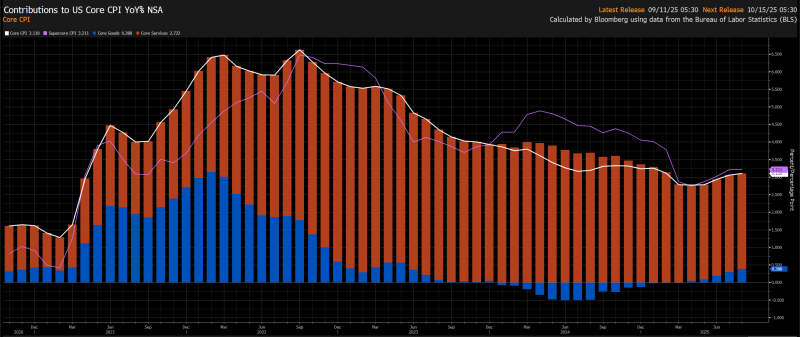

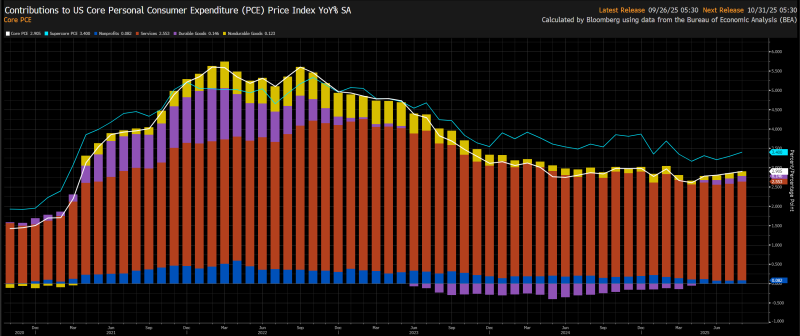

The charts paint a consistent picture across both measures:

- Core PCE at 2.9% YoY: Services are doing all the heavy lifting here, contributing 2.55 percentage points while goods barely register. Services inflation - think rent, healthcare, dining out - refuses to budge much.

- Core CPI at 3.1% YoY: Same story. Core services add 2.72 points to the total, while goods inflation has completely fizzled out from its 2021-22 peak. The goods component that once drove inflation crazy has basically disappeared.

Bottom line: inflation stopped climbing, but it also stopped falling. It's just sitting there, above the Fed's comfort zone.

Why It Won't Come Down

Services inflation is the stubborn piece. Housing costs, healthcare, and anything requiring human labor keeps pushing prices up. The job market has cooled some, but wages are still higher than before the pandemic - enough to keep services prices elevated. And here's the kicker: goods prices already normalized. Supply chains are fixed, and those price drops already happened. There's nothing left to pull inflation lower. That's your floor.

Despite all this, the Fed cut rates anyway. They're betting they can goose growth without inflation snapping back. The message from policymakers is basically "trust us, services inflation won't re-accelerate." That's a risky call when you're cutting rates while inflation sits above your own target. If they're wrong, their credibility takes a hit.

What It Means for Markets

This setup creates some interesting dynamics. Stocks get a boost from lower rates, but sticky inflation might cap how much valuations can run. Bonds are going to be choppy as traders wrestle with dovish policy versus inflation that won't quit. Gold looks solid - rate cuts plus persistent inflation is basically the perfect recipe for the yellow metal. And the dollar could weaken if other central banks keep rates higher while the Fed eases.

Peter Smith

Peter Smith

Peter Smith

Peter Smith