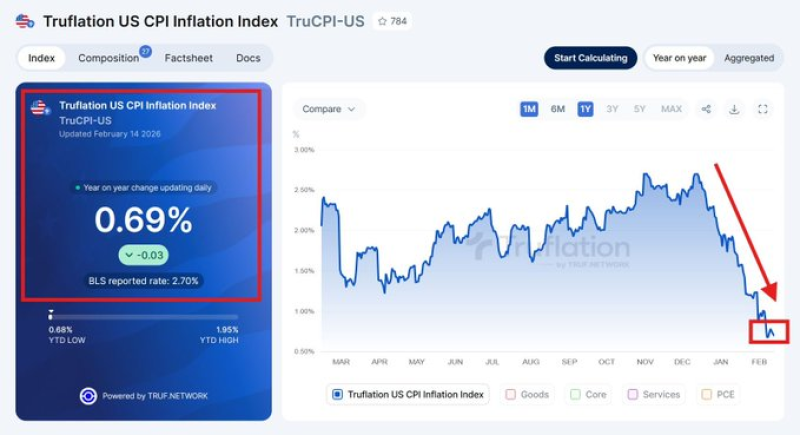

Two very different pictures of American inflation emerged in February. While the Bureau of Labor Statistics pegged consumer price growth at 2.70%, Truflation's daily-updated index tells a completely different story—registering just 0.69% year-over-year. That's not a rounding error. It's a yawning gap that's forcing traders and policymakers to ask: which number should we actually trust?

Real-Time Data Shows Inflation Below 1%

The disconnect became impossible to ignore flagged the widening spread between the two measures. Truflation's dashboard reveals inflation peaked in mid-2025 before plunging through early 2026, hitting a year-to-date low under 1% after touching nearly 1.95% earlier in the period.

What happened to all those tariff fears? Markets spent much of 2025 bracing for a wave of import-driven price increases. Instead, real-time data now suggests that threat fizzled faster than anyone predicted.

That single sentence captures the stakes—if Truflation is right, the Fed may be fighting yesterday's war.

Why the Numbers Diverge So Sharply

The gap isn't about bad math. It's about speed. Truflation pulls pricing signals daily from thousands of sources, giving it a live pulse on what consumers actually pay. The BLS, by contrast, releases monthly snapshots based on data collected weeks earlier. When inflation shifts quickly, those lags create serious blind spots.

For context, check out US inflation gap hits 200 basis points and Inflation gap widens as TruCPI and TruPCE track below BLS for deeper dives into the methodology split.

This isn't the first time alternative measures have challenged official readings. Earlier reports showed Independent data shows US CPI at 0.72% as markets await official release, hinting that the divergence has been building for weeks.

What It Means for Markets and Policy

Inflation expectations drive everything—from mortgage rates to stock valuations to Fed meeting bets. If traders believe the 0.69% figure over the 2.70% print, rate-cut odds should be climbing. But with the official number still hovering near the Fed's 2% comfort zone (and well above it), policymakers face a messy choice: trust the lagging official data or acknowledge that prices may have cooled more than the statistics admit.

The February split reignites a bigger question that never really went away: are we measuring inflation correctly in a world where prices update in real time but policy moves on month-old snapshots?

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova