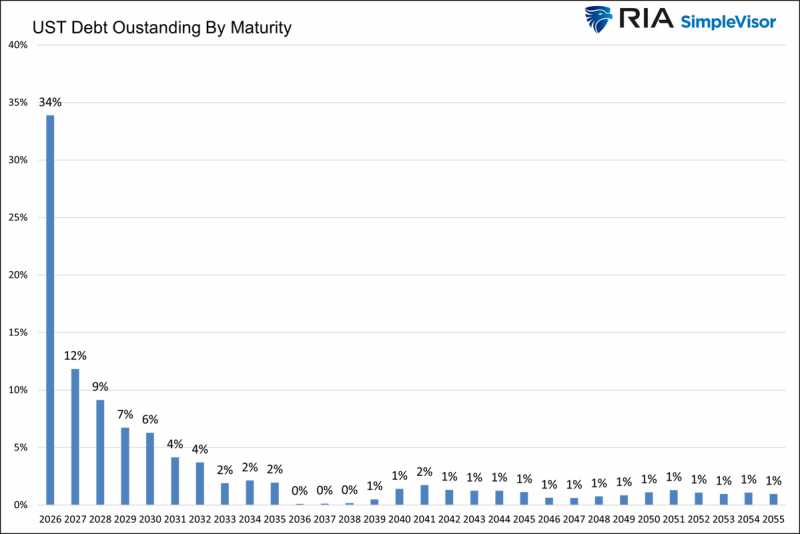

⬤ Here's the thing—America's debt situation just got way more interesting. New data shows that U.S. national debt's hit 100% of GDP, and we're now paying about $1 trillion a year just in interest. That's roughly 18% of all federal revenue going straight to servicing debt. But here's the kicker: 34% of all outstanding Treasury debt matures in 2026, another 12% in 2027, and 9% in 2028. Do the math—that's over half the entire debt pile that needs refinancing within three years.

⬤ This creates a pretty serious problem. Most of that debt was issued when rates were near zero, and now it's gotta be rolled over at today's much higher yields. Even if the government doesn't borrow another dime, interest costs are climbing at double-digit rates year-over-year. That structural increase isn't going away anytime soon, and it's already putting real pressure on the federal budget as these massive rollover waves keep coming.

⬤ The risks here aren't just theoretical. Analysts at the Committee for a Responsible Federal Budget laid out multiple scenarios—everything from inflation spikes and currency instability to forced spending cuts or years of sluggish growth. With so much debt rolling over at higher rates, the government's losing flexibility to respond to unexpected hits like recessions, wars, or health crises. It's less about some dramatic crash and more about a slow grind where budget constraints get tighter and economic growth potential weakens. Bottom line: this Treasury refinancing wave is becoming one of the biggest macro stories for the next few years.

Usman Salis

Usman Salis

Usman Salis

Usman Salis