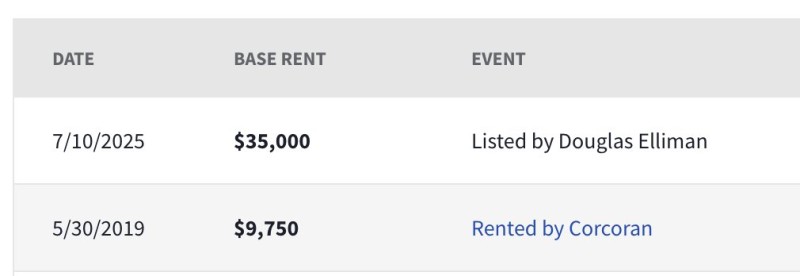

Rent prices in high-end U.S. markets are climbing at a rate that tells a story official inflation numbers can't fully explain. Take one property that rented for $9,750 a month back in 2019. By mid-2025, that same listing hit $35,000 - a jump that says more about the state of housing than any government report.

Rental Growth Outpaces Official Inflation

This kind of surge shows just how far real costs have drifted from what you'd expect based on headline inflation. Trader based16z pointed out that while the U.S. inflation rate hovers around 3% officially, what's actually happening in markets like housing is a different beast entirely.

We're talking about a more than 250% increase in rent over six years - not the modest creep you'd anticipate from a 3% annual rate.

The numbers are stark. In May 2019, the property was rented at $9,750, a typical pre-pandemic rate. Fast forward to July 2025, and it's listed at $35,000. That's not just inflation - it's a signal of scarcity, demand, and how much people with means are willing to pay for premium space.

What's Driving This

Several forces are pushing luxury rents into the stratosphere. Supply is tight, especially in major cities where new luxury inventory hasn't kept pace with demand. High interest rates have made buying less attractive, so more people who would've purchased are now renting instead. And there's the wealth factor - affluent households are competing harder for the best properties, driving prices up even further.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov