Japan's latest inflation data is raising fresh questions about whether the Bank of Japan's tightening cycle can hold up - and whether the yen's macro story is about to shift. Economist Steve Hanke has been tracking the numbers closely, and with money supply growth barely above 1.5% and inflation still short of target, his read is that the story goes well beyond what rate decisions alone can explain.

Below Target: What Japan's January Numbers Really Show

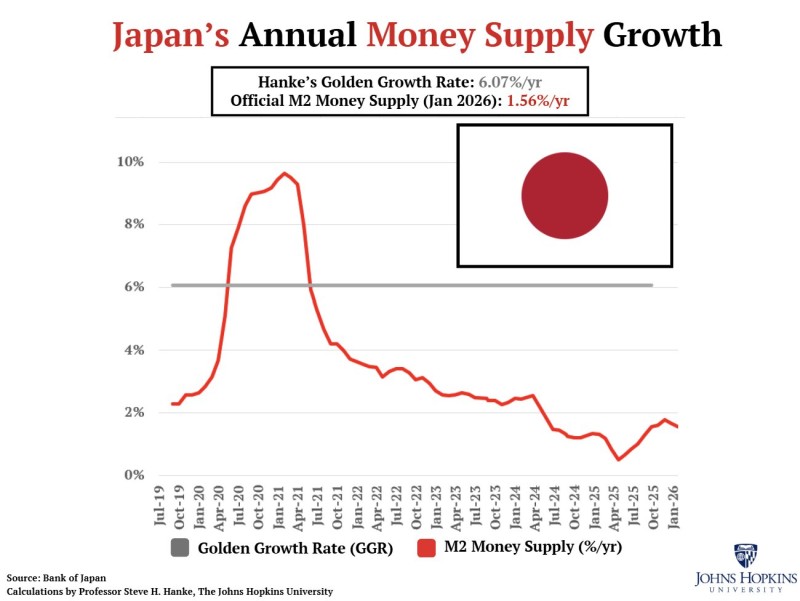

Japan's inflation came in at 1.53% year over year in January, missing the Bank of Japan's 2% target, while M2 money supply growth ran at just 1.56% per year. According to economist Steve Hanke, that pace is well below his "Golden Growth Rate" of roughly 6.07% per year - the level he associates with inflation sustainably anchored near 2%.

The chart of Japan's annual M2 growth tells a clear story. Money supply climbed from the low-2% range in mid-2019, peaked near 9-10% around 2020 to early 2021, then fell steadily through 2022-2024 before settling close to 1.5% by January 2026. A reference line at the 6.07% Golden Growth Rate makes the shortfall impossible to ignore - Japan's M2 growth is running at barely a quarter of that benchmark.

The inflation story is a money supply story.

Why the M2 Gap Matters for BOJ Policy and the Yen

The mismatch between 1.56% M2 growth and the 6.07% reference level backs up Hanke's long-standing argument that liquidity conditions are the real driver of inflation - not just central bank rate decisions. It positions money supply as the key lens for understanding why Japan's inflation keeps struggling to hold at 2%, even as Bank of Japan rate increases to 0.75%, the highest level in 30 years.

That combination of below-target inflation and subdued money growth carries real weight for markets. It shapes expectations around the BOJ's next moves and feeds directly into the yen's macro narrative. Traders have been watching USD/JPY reacts to BOJ policy pause expectations, while Japan's 30-year bond yield reaching 3.29% adds another layer of complexity to an already shifting rate environment.

Until M2 growth closes the gap with Hanke's benchmark, Japan's inflation story is likely to stay unresolved - and so is the debate over what the BOJ does next.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi