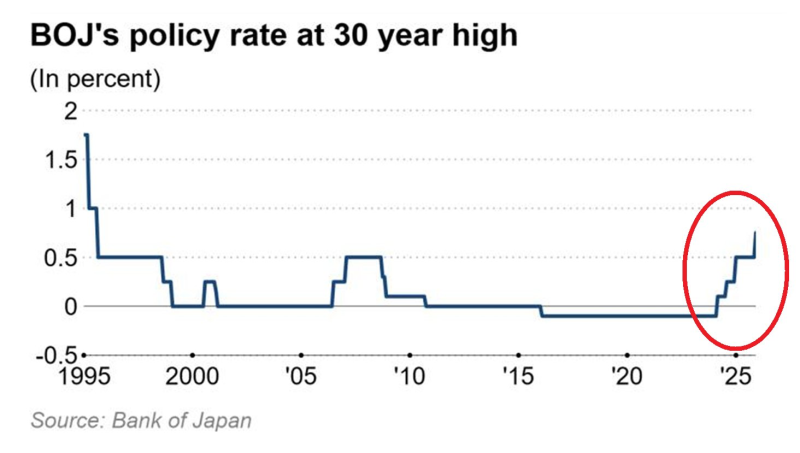

⬤ The Bank of Japan took another step toward policy normalization this week, bumping up its benchmark rate by 25 basis points to 0.75% - the highest it's been in 30 years. This marks the fourth rate increase since the central bank ditched its negative interest rate policy back in March 2024. After spending most of the past decade stuck at or below zero, Japan's policy rates have climbed sharply, showing just how dramatically the landscape has shifted.

⬤ This is the first rate hike since January 2025, and it puts Japan on a very different path than most other major economies. The rate gap between Japan and the U.S. has tightened by about 125 basis points this year, bringing the difference down to roughly 3.0%. While other central banks have hit pause or slowed down, Japan keeps pushing forward with tighter monetary conditions.

⬤ Core price measures continue running above the Bank of Japan's 2% target, which is why policymakers aren't backing off yet. They've made it clear that more rate hikes are on the table if the economy keeps tracking with their forecasts, showing they're serious about keeping inflation under control.

⬤ Markets didn't waste time responding to the news. Japan's 10-year government bond yield jumped above 2% for the first time in nearly 20 years - a big deal that shows how fundamentally things are changing in Japan's financial system. After years of rock-bottom rates, borrowing costs are heading higher, and that's rippling through currency markets, investment flows, and financial stability across the region.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi