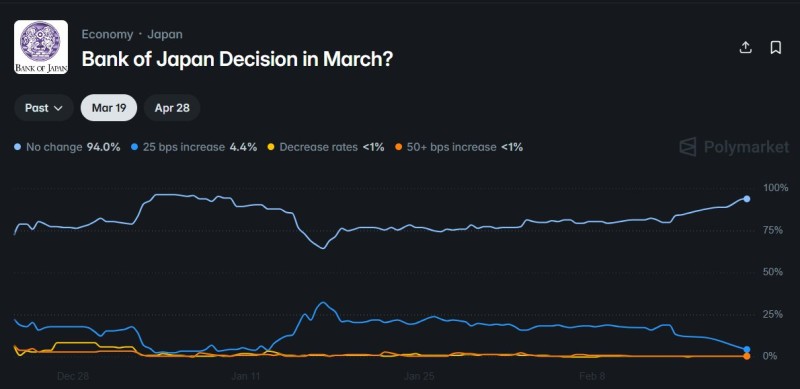

⬤ USD/JPY and broader FX markets are locking in on a near-certain BOJ pause at the March 2026 meeting. Polymarket's probability chart puts "no change" at 94.0%, with a 25 bps hike sitting at just 4.4%, and cuts or larger moves barely registering below 1%. That kind of consensus doesn't happen in a vacuum.

⬤ The inflation picture tells most of the story. Headline CPI came in at 1.5% against a 2.1% expectation, a miss that took a lot of wind out of the hawkish sails. As Max Crypto noted, the softer print is doing the heavy lifting in keeping the BOJ sidelined for now, complicating its communication heading into spring.

Inflation has slowed to 1.5% versus a 2.1% expectation, reinforcing expectations for a hold.

⬤ That doesn't mean the bulls have given up entirely. BofA expects the Bank of Japan to hike rates to 1.00% in April, which keeps the longer-term tightening story alive even as March looks like a done deal for a pause. The contrast between Polymarket's 94% hold probability and that kind of hawkish call shows just how split the broader market remains on the BOJ's path.

⬤ Yen dynamics are feeding into this too. Shifting rate expectations have a direct line into yen performance, a theme explored in JPY forecast: trade-weighted index eyes new 2025 lows. Meanwhile, bond markets aren't sitting still either, with Japan's 10-year yield climbs toward a 17-year peak keeping traders focused on how macro data and BOJ guidance shape positioning into the next meetings.

⬤ The March decision carries weight beyond Japan. The BOJ sits at the center of global rate-differential trades, and even small shifts in policy expectations can trigger outsized moves across yen pairs. With inflation undershooting, markets are comfortable pricing a hold for now, but the debate over April and beyond is very much still open.

Peter Smith

Peter Smith

Peter Smith

Peter Smith