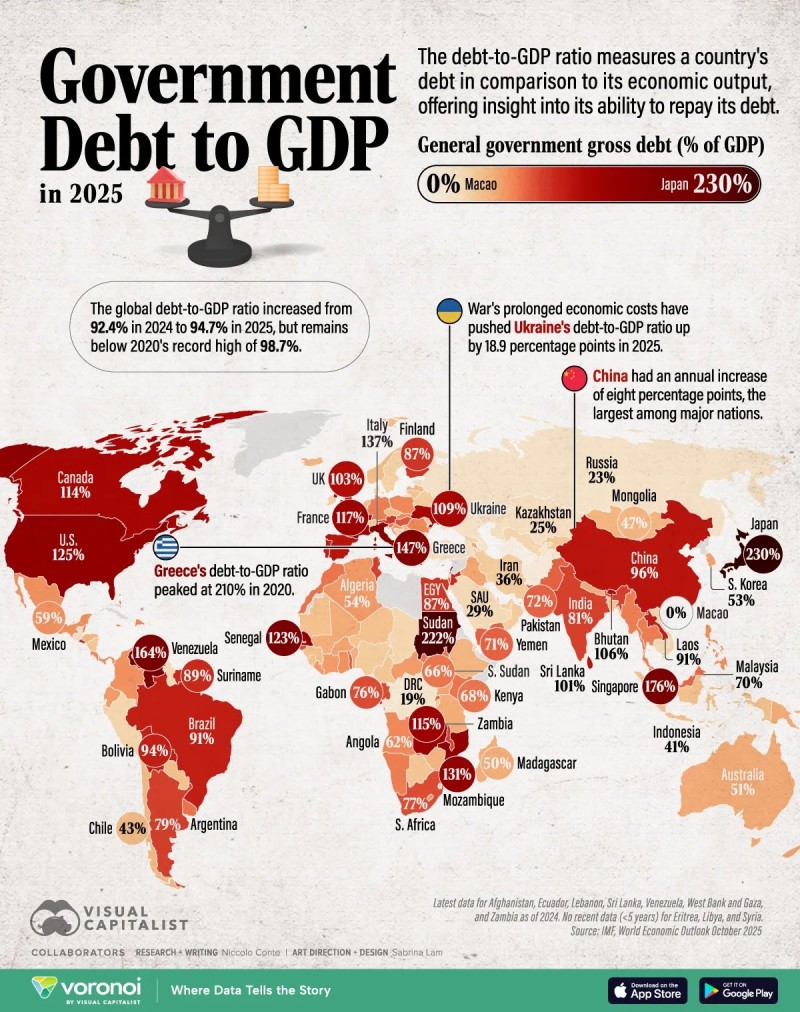

The global economy is still wrestling with unprecedented debt levels, and recent data shows the problem isn't going away. A visualization from Visual Capitalist, based on the IMF's World Economic Outlook from October 2025, highlights just how bad things have gotten. Japan sits at the top with a debt-to-GDP ratio of 230%, marking it as the most heavily indebted nation on earth. Though global debt dropped slightly from its pandemic peak of 98.7%, the current ratio of 94.7% tells us governments are still leaning hard on borrowing to keep things moving.

Global Debt Overview: Stabilizing but Still High

According to financial analyst Barchart, while global debt has come down a bit from 2020's record highs, it's still dangerously elevated. The worldwide debt-to-GDP ratio went from 92.4% in 2024 to 94.7% in 2025, showing that both developed and emerging markets keep borrowing.

Developed economies are carrying the heaviest load because of years of stimulus and social spending. Emerging markets, meanwhile, are facing growing repayment risks with high interest rates and a strong dollar. The pandemic kicked off the debt surge, but now inflation, energy costs, and geopolitical conflicts are keeping it going.

Regional Highlights

- Japan – 230% of GDP: Japan's debt ratio has hit an extraordinary 230%, the highest globally. This comes from decades of aggressive fiscal stimulus, ultra-low interest rates, and demographic pressures. The government keeps funding itself through domestic bond sales, and while most debt is held by local investors, questions about sustainability are growing as the population ages and the workforce shrinks.

- Greece – 147% of GDP: Greece was once the poster child for Europe's debt crisis. Its ratio has dropped from 210% in 2020 but still ranks among the world's highest. Growth and fiscal reforms have helped, but high borrowing costs in the eurozone make further progress tough.

- United States – 125% of GDP: The U.S. debt-to-GDP ratio is hovering near record levels. Massive federal spending on infrastructure, defense, and social programs has kept public debt high, and rising interest payments are squeezing the budget. Within a few years, the Treasury's debt servicing costs are expected to surpass defense spending.

Asia and Emerging Markets: Rising Fiscal Pressure

Asia's largest economies show mixed results. China saw one of the sharpest increases, jumping 8 percentage points to 96% due to stimulus and local government borrowing. India continues expanding public spending to fuel growth and sits at 81%. Pakistan at 72% and Sri Lanka at 101% are in fiscal distress with heavy external debt. Macao, in sharp contrast, maintains the world's lowest debt at 0% thanks to strong gaming revenue and tight fiscal management. In Eastern Europe, Ukraine's debt surged to 109% amid ongoing war costs, climbing nearly 19 percentage points in one year.

The Americas: Diverging Paths

Debt levels across the Western Hemisphere show stark differences. Canada at 114% and the U.S. at 125% are among the most indebted developed nations. Brazil at 91% and Venezuela at 164% keep struggling with inflation and weak fiscal control. Mexico, however, holds a relatively moderate 59% despite slower growth.

Africa and the Middle East: Fiscal Strain Persists

Africa's average debt ratio sits around 70-80%, but several countries exceed 100%, including Mozambique at 131%, Egypt at 87%, and Sudan at 222%. High borrowing costs, inflation, and reliance on external funding keep these economies unstable. In the Middle East, Saudi Arabia at 29% and Iran at 36% keep their ratios lower thanks to oil revenues, while Pakistan and Egypt struggle with heavy external debt repayments.

Key Takeaways: The World's Debt Challenge

Governments are leaning on borrowing not just to stimulate growth but to keep basic economic activity going. This reflects a long-term structural dependency rather than a temporary fiscal strategy. With central banks holding rates high to combat inflation, debt servicing costs are climbing. This poses a serious threat to advanced economies with aging populations and sluggish GDP growth. Developing nations with large foreign-currency debts face heightened default risk, especially if capital keeps flowing out and the dollar stays strong.

Peter Smith

Peter Smith

Peter Smith

Peter Smith