The summer of 1979 marked a pivotal moment in U.S. monetary policy history. As inflation surged into dangerous double-digit territory, the Federal Reserve found itself caught between competing priorities—fighting rising prices while avoiding further damage to an already struggling job market. This policy paralysis would ultimately contribute to one of the most severe stagflation crises in American economic history.

The Crisis Unfolds

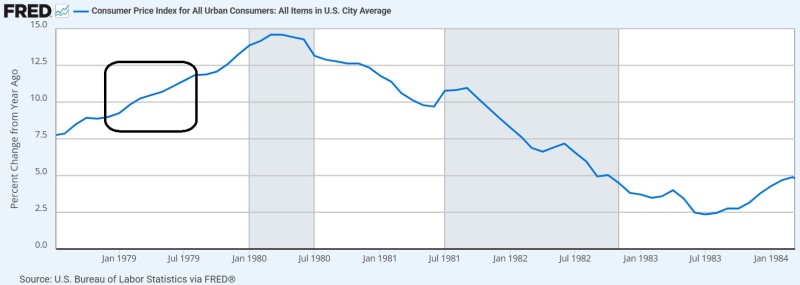

As Danny Dayan highlights, by June 1979, the U.S. economy was showing clear signs of distress. Consumer price inflation had jumped dramatically from 9.5% in January to 11.5% by mid-year, yet the Federal Reserve kept interest rates frozen. The reason? Unemployment had remained stubbornly above 6% for over a year, creating a policy dilemma that would define the era.

This situation created a dangerous feedback loop. While the Fed worried about worsening unemployment through rate hikes, their inaction allowed inflation expectations to become deeply embedded in the economy. Workers demanded higher wages to keep up with rising prices, businesses raised prices to maintain margins, and the cycle accelerated.

The FRED chart from this period tells the story clearly. The steady climb in consumer prices from early 1979 through summer shows inflation breaking decisively into double digits with no signs of retreat. What makes this particularly troubling is that the Fed's response was essentially nothing—rates remained unchanged despite mounting evidence that price pressures were spiraling out of control.

Key Economic Indicators

- Sharp inflation acceleration: Consumer prices jumped from under 10% to above 11% in just six months

- Policy inaction: The Federal Reserve made no adjustments to interest rates despite clear warning signs

- Growing structural risks: This hesitation allowed inflation expectations to harden, setting the stage for the harsh monetary medicine that would follow under Paul Volcker

Understanding the Fed's Dilemma

The late 1970s presented central bankers with an unprecedented challenge: stagflation. This toxic combination of stagnant economic growth, high unemployment, and surging prices defied conventional economic wisdom. The Fed's dual mandate—maintaining both price stability and full employment—created an impossible choice. Every policy option seemed to risk making one problem worse while potentially helping the other.

By choosing the path of least resistance, policymakers hoped to avoid triggering a recession. Instead, they prolonged economic instability and seriously damaged the central bank's credibility. Markets began to doubt whether the Fed had the will to fight inflation, which only made their eventual job harder.

Lessons for Modern Policymakers

The 1979 episode offers crucial insights for today's central bankers. Once inflation becomes entrenched in an economy, restoring stability requires increasingly dramatic action. The Fed's hesitation turned what might have been a manageable problem into a crisis that would require the severe recession of the early 1980s to resolve.

Central banks that delay decisive action often find themselves facing a harder choice later: accept permanently higher inflation or impose much more painful adjustments on the economy. Credibility, once lost, is expensive and difficult to rebuild.

Peter Smith

Peter Smith

Peter Smith

Peter Smith