The Federal Reserve finds itself at a crossroads as new housing data challenges the narrative of persistent inflation. While official Consumer Price Index figures continue to show elevated price pressures, real-time housing market indicators tell a dramatically different story. This divergence between official statistics and market reality is creating mounting pressure on policymakers to reassess their approach to interest rates, with some analysts calling for aggressive cuts to prevent unnecessary economic damage.

Housing Market Signals Point to Hidden Deflationary Forces

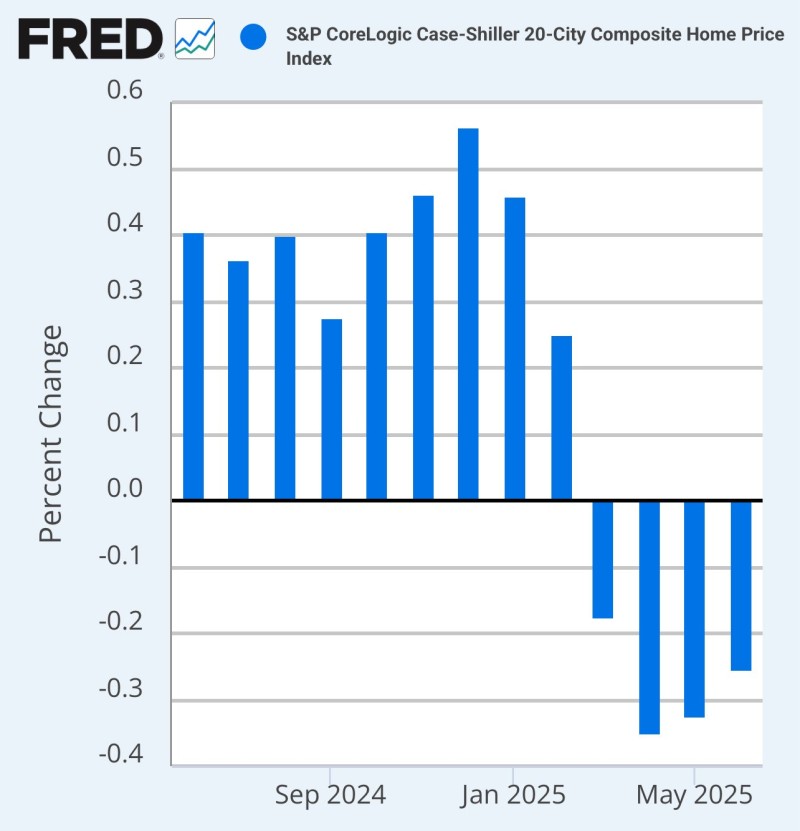

Recent analysis by James E. Thorne reveals a striking discrepancy between official inflation readings and actual housing market conditions. The Case-Shiller 20-City Composite Home Price Index shows a marked decline that, if incorporated into Consumer Price Index calculations, would dramatically alter the inflation picture. Specifically, substituting the shelter component of August 2025's CPI with Case-Shiller data would reduce annual inflation to just 0.54%, well below the official 2.9% reading.

The housing market's trajectory has shifted decisively. After steady price appreciation throughout late 2024 and early 2025, the Case-Shiller index has entered negative territory, with the latest four-month annualized rate showing a concerning -3.07% decline. Monthly price growth, which peaked near 0.55% in early 2025, has turned negative with readings between -0.2% and -0.35% recorded in mid-2025.

The Critical Timing Lag in Official Statistics

The disconnect between market reality and official statistics stems from methodological limitations in how the Bureau of Labor Statistics calculates shelter costs. Despite accounting for over one-third of the CPI, shelter cost calculations incorporate significant lags that fail to capture real-time market movements. This means official inflation data continues reflecting outdated housing price trends even as actual market conditions deteriorate.

This timing mismatch creates serious policy risks. Federal Reserve decisions based on lagging CPI data could maintain overly restrictive monetary policy even as genuine inflationary pressures dissipate. Such misalignment threatens to unnecessarily constrain economic growth and could push the economy toward recession despite underlying price stability.

Market Pressure Builds for Aggressive Rate Relief

The emerging data has prompted calls for more aggressive monetary easing, with some analysts advocating for a 50 basis point rate reduction. Proponents argue that such action would provide necessary relief to interest rate-sensitive sectors including housing and equity markets while potentially reducing Treasury yields and weakening the dollar. However, the Federal Reserve faces a delicate balancing act, as cutting rates too aggressively while official CPI readings remain near 3% could undermine its hard-won credibility in fighting inflation.

Future Implications and Market Outlook

The Case-Shiller index suggests that inflation has already cooled substantially beyond what official statistics indicate. If this trend continues, the Federal Reserve may face increasing pressure to realign monetary policy with economic reality sooner than currently anticipated by financial markets. For investors, the central question is not whether inflation remains under control—evidence suggests it likely is—but rather how long policymakers will maintain restrictive policies based on outdated data. The resolution of this disconnect between official metrics and market reality will likely determine both the trajectory of interest rates and broader economic conditions in the months ahead.

Peter Smith

Peter Smith

Peter Smith

Peter Smith