The Federal Reserve's policy decisions are under growing scrutiny. His analysis shows a troubling pattern — whenever the Fed has maintained restrictive interest rates while unemployment started rising, a recession typically followed.

The Chart Shows a Clear Pattern

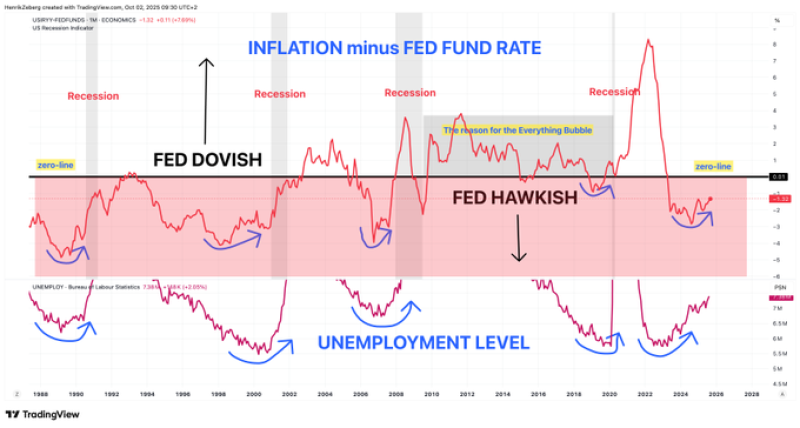

Macro strategist Henrik Zeberg recently argued that the Fed remains too hawkish, repeating a historic mistake: keeping policy too tight even as the job market weakens. Zeberg's chart tracks the gap between inflation and the Fed Funds rate alongside unemployment levels over four decades. When that gap drops below zero, it means the Fed is being restrictive. What stands out is the consistency: every time the Fed stayed hawkish while unemployment began ticking up — in the early 1980s, early 2000s, 2008, and early 2020s — the economy fell into recession. Right now, we're seeing that same setup again. The policy rate sits well above inflation, and unemployment has started moving higher after hitting historic lows.

Why This Matters Now

The Fed has kept rates elevated even as inflation cooled, seemingly more concerned with maintaining credibility than adjusting quickly. But holding rates too high for too long carries real risks. The labor market is showing early signs of stress, borrowing costs are squeezing households and businesses, and the pattern from previous cycles suggests we could be heading for a contraction. Each past episode of tightening into rising unemployment ended badly.

Zeberg also points out the irony here. After 2008, the Fed's ultra-loose policy helped inflate what many called the "Everything Bubble" across stocks, bonds, and crypto. Now the pendulum has swung the other way, and prolonged tightness risks overcorrecting straight into recession.

If the Fed cuts rates soon, it might stabilize the job market but could also reignite inflation concerns. If they stay tight, a deeper slowdown looks increasingly likely, putting pressure on equities and other risk assets. Either way, investors should be watching unemployment data and Fed signals closely in the months ahead.

Peter Smith

Peter Smith

Peter Smith

Peter Smith