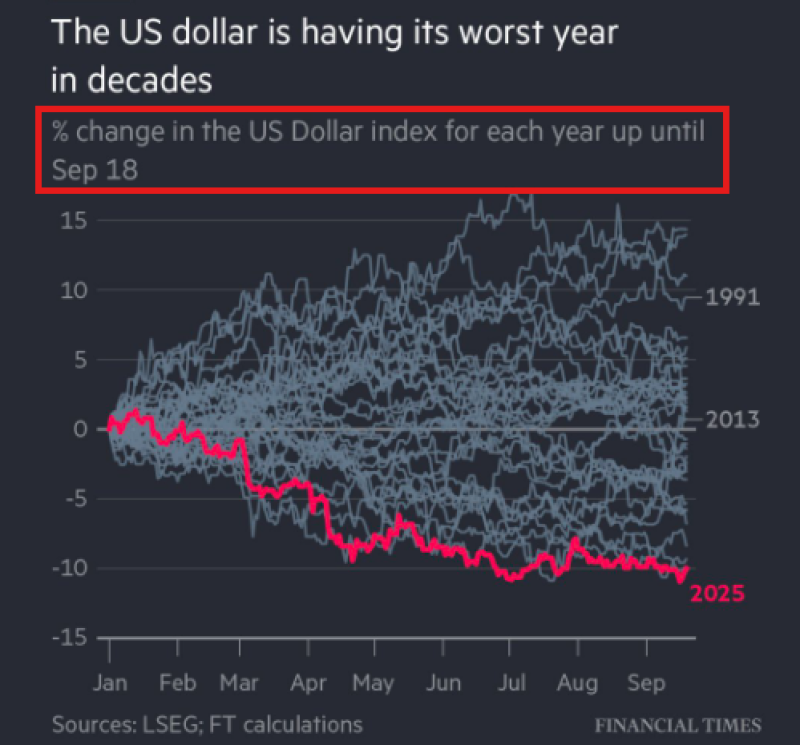

The dollar is having its worst year since the Nixon era. Down more than 10% in 2025, the U.S. Dollar Index is experiencing a collapse that hasn't been seen in generations. And here's the kicker: the Federal Reserve is cutting rates while core inflation sits above 2.9%—something that hasn't happened in over three decades.

The Numbers Don't Lie

As The Kobeissi Letter points out, this isn't just a bad year. It's a structural crack that's pushing investors toward alternatives.

Key metrics painting a grim picture:

- 2025 performance: Down over 10% year-to-date, marking the sharpest annual decline since 1973

- Long-term erosion: Since 2000, the dollar has lost more than 40% of its purchasing power

- Policy disconnect: Fed cutting rates despite Core PCE inflation above 2.9%—unprecedented in 30+ years

- Chart deviation: Unlike typical years that fluctuate and stabilize, 2025 shows a relentless downward slide with no recovery

The Financial Times chart makes it crystal clear. While gray lines representing past years show normal volatility, the red line for 2025 just keeps falling. This isn't a routine cycle—it's a breakdown.

The dollar's collapse isn't coming out of nowhere. The Fed's rate cuts have stripped away the dollar's yield advantage against other currencies, making it less attractive to hold. Meanwhile, U.S. debt keeps climbing and the fiscal situation looks shakier by the month. Central banks worldwide are responding by dumping dollar reserves in favor of gold, euros, and other assets. And everyday investors? They're losing faith fast, turning to hedges like gold and Bitcoin instead of trusting the greenback.

Where the Money's Going

Gold is already trading above $3,800, near record highs, doing exactly what it's supposed to do when fiat currencies stumble. Bitcoin is playing its "digital gold" role, attracting flows from people who question whether traditional money still works. Both assets are positioned to capture even more capital if the dollar keeps sliding. The tweet's closing line says it all: "Gold and Bitcoin know what's coming next."

The big questions hanging over markets: Did the Fed jump the gun on rate cuts? Can Washington restore any fiscal credibility? Or is this the start of a longer decline in dollar dominance? One thing's certain—unless something changes fast, the dollar's role as the world's reserve currency is facing its biggest test in decades. For investors, that means gold and Bitcoin aren't just alternatives anymore. They might be necessities.

Peter Smith

Peter Smith

Peter Smith

Peter Smith