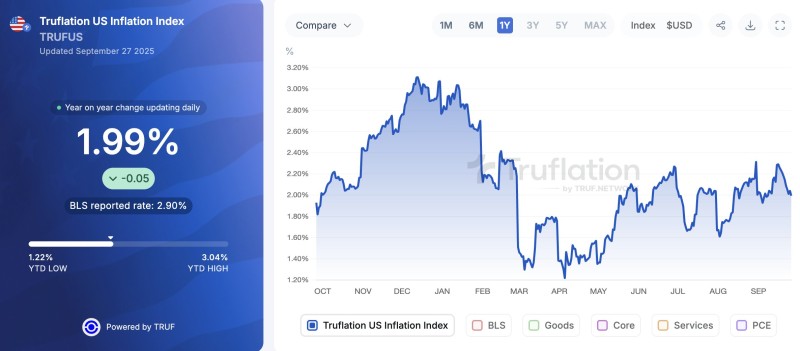

U.S. inflation hit a major milestone, dropping to 1.99% according to the Truflation Index - the first time it's gone under 2% this year. Compare that to the Bureau of Labor Statistics' official reading of 2.9%, and you've got a pretty big disconnect between what's happening in real-time versus what the government reports.

What the Charts Are Saying

Trader Crypto Rover called this development potentially bullish for Bitcoin and crypto, suggesting digital assets could benefit as the macro picture shifts in their favor.

Looking at inflation's wild ride over the past year, a few things stand out:

- Early 2025 spike: Inflation shot above 3%

- Sharp spring cooldown: March and April saw the steepest drops since late 2023

- Summer chop: Sideways action with several bounces around 2.5%

- Latest break: The current sub-2% reading marks a clear departure from recent trends

This matters because the Fed has always used 2% as its North Star. Going below that threshold signals cooling price pressures and opens the door for easier monetary policy.

Why Crypto Could Win Big

Lower inflation creates several tailwinds for Bitcoin and digital assets. Risk appetite typically returns when inflation fears fade, pushing investors toward higher-growth plays. A softer inflation outlook can also weaken the dollar, which indirectly supports crypto prices. And while Bitcoin is often pitched as an inflation hedge, it actually tends to thrive when monetary easing floods the system with liquidity.

Looking Ahead

If inflation stays below 2% through Q4, the Federal Reserve could face serious pressure to start cutting rates in 2026. That kind of policy shift would likely fuel major rallies in Bitcoin, Ethereum, and the broader altcoin market. The question isn't whether this will impact crypto - it's how much.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah