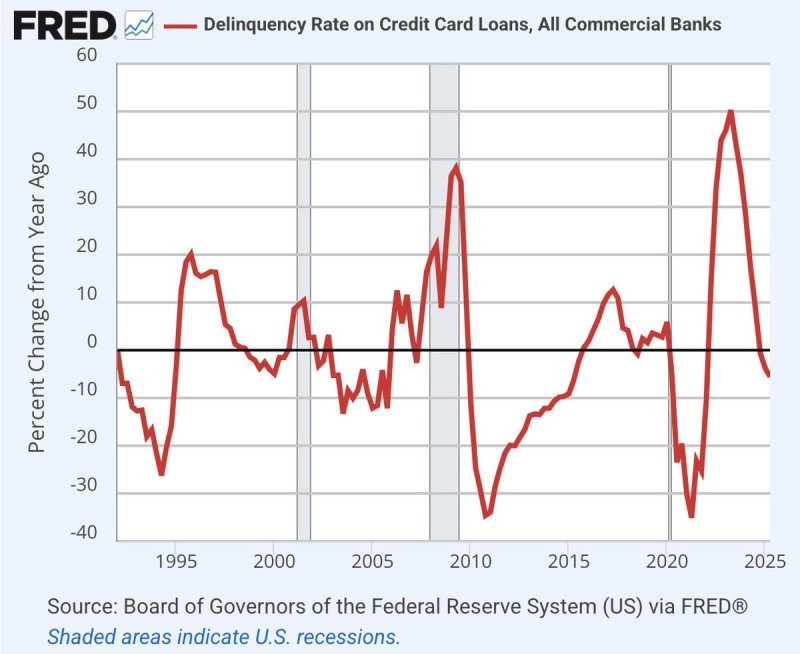

While headlines continue warning about a looming credit crisis, Federal Reserve data tells a different story. U.S. credit card delinquency rates aren't climbing—they're dropping at one of the fastest rates we've seen in decades.

The Real Numbers

Financial analyst Seth Golden recently pointed out this disconnect between media coverage and actual data from the Federal Reserve's FRED database. After delinquency rates surged nearly 50% year-over-year in 2023, they've since collapsed in what looks more like a cliff dive than a gradual decline.

The 2023 peak was dramatic, with delinquency growth hitting almost 50% year-over-year—levels that reminded many of the 2008 financial crisis. But by mid-2024, something changed. The rate of change flipped negative, showing rapid improvement in how people were managing their credit card payments. This pattern isn't entirely new—we saw similar reversals in the early 1990s and after the 2008 recession, typically when economic stress gave way to stabilization.

What's Driving the Turnaround

The improvement seems to stem from several converging factors. Strong labor markets continue supporting household finances with unemployment remaining low. Wage growth is helping offset higher borrowing costs that have squeezed many consumers. Meanwhile, banks have pulled back on lending to riskier borrowers, effectively shrinking the pool of potential delinquencies.

Looking Ahead

This sharp drop in delinquency growth is certainly encouraging news for both consumers and the broader economy. However, caution remains warranted. Consumer debt balances are still at record highs, and interest rates remain elevated compared to the ultra-low levels of recent years. Any significant weakening in the job market could quickly reverse these positive trends, making employment data a key indicator to watch in the months ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis