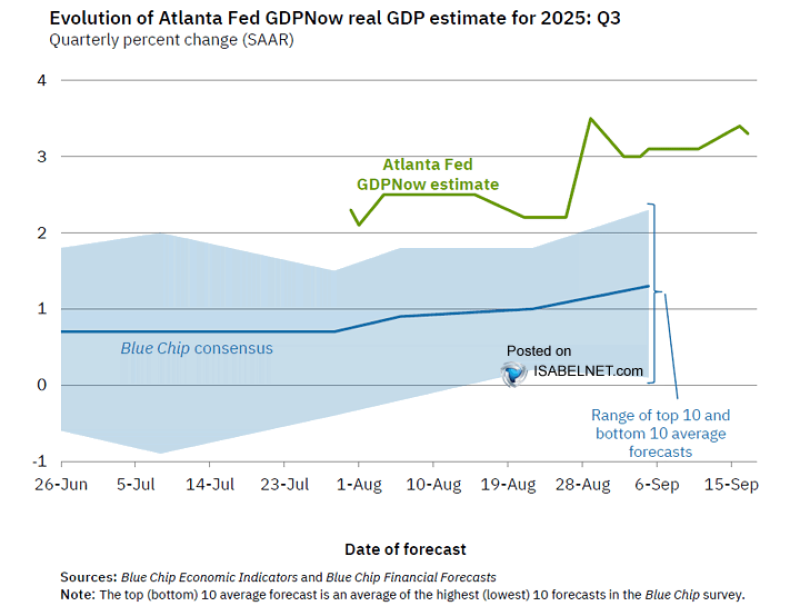

Something interesting is happening with GDP forecasts, and it's creating a serious divide between the data nerds and Wall Street analysts. The Atlanta Fed's GDPNow model just dropped its latest reading: 3.3% annualized growth for Q3 2025. That's more than triple what most private economists are expecting. This isn't just a small disagreement - it's highlighting a fundamental split about where the economy is actually heading.

The Numbers Don't Lie - But They Tell Different Stories

The Atlanta Fed's real-time tracker has been climbing steadily since late August, now sitting comfortably above 3%. Meanwhile, the Blue Chip consensus - that's the average of top forecasters - is stuck around 1% and hasn't budged much in months. As ISABELNET pointed out, this suggests the U.S. economy might be more resilient than anyone thought, even with global headwinds picking up steam.

What's Actually Driving This Optimism

The stronger outlook isn't coming out of nowhere. Consumer spending is holding up remarkably well thanks to a solid job market that keeps delivering steady paychecks and wage growth. People are still shopping and spending on services, which is keeping the domestic engine running. Business investment is also staying surprisingly firm, especially in manufacturing and tech. Even with higher borrowing costs, companies aren't backing down from capital spending, which signals they're still confident about the future.

The policy mix is working too. The Fed's gradual approach to tightening, combined with supportive fiscal measures, has managed to cool things down without breaking anything. It's like threading a needle, but somehow it's working.

Before we get too excited, there are real risks that could flip this script. Higher interest rates are still working their way through the system and could eventually hit both consumers and businesses harder. Inflation might start eating into those wage gains people are enjoying. And let's not forget about global weakness - if Europe and China keep struggling, U.S. exports will feel the pain.

If these headwinds get stronger, we might see the GDPNow numbers start falling back toward those more cautious Wall Street forecasts.

Usman Salis

Usman Salis

Usman Salis

Usman Salis