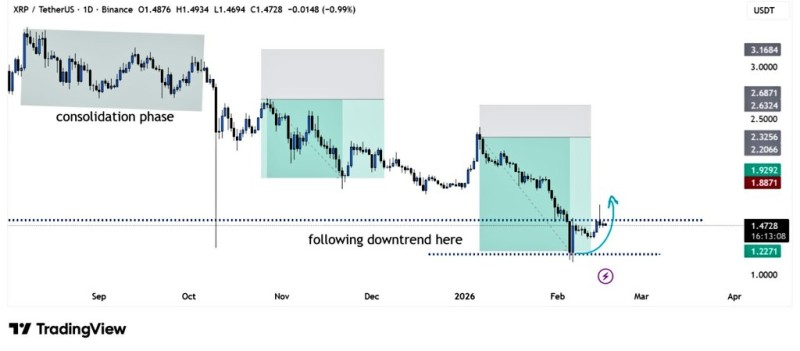

⬤ XRP is trying to stabilize after a rough stretch, bouncing off a local bottom near $1.22 and now pushing into a key horizontal zone around $1.47. The market is attempting to flip former support that previously acted as a breakdown point — a meaningful shift if it holds.

⬤ The chart tells a familiar story: consolidation, a sustained leg down, and a final capitulation into February. What makes this bounce different is where price is approaching from — below the breakdown level, not above it. That's the setup that matters. Historically, these kinds of XRP reclaim scenarios have marked real changes in trend posture, not just dead-cat bounces.

⬤ Hold this level, and the next logical target becomes the $1.80–$2.00 zone — the ceiling of the prior consolidation range visible earlier in the structure. Lose it, and the broader bearish setup stays intact. Similar dynamics have played out recently across resistance-breakout structures and mid-range breakout zones in XRP analysis coverage.

⬤ What's at stake here isn't just price — it's market behavior. Reclaiming a structural level shifts conditions from trend continuation to potential recovery. Acceptance above $1.47 signals the market is transitioning away from the prior downtrend. Rejection keeps XRP locked in the same directional pressure. The next few sessions will settle it.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah